Why the economy sucks (in one chart)

(The following is something I’ve prepared for the next issue of CUPE’s Economy at Work, a popular economics quarterly publication I produce.)

In his annual Economic and Fiscal Update (EFU), finance minister Joe Oliver told Canadians that while the federal government will finally record a surplus next year after seven years of deficits, we can’t expect the economy to grow much faster than the slow growth we’ve experienced since the financial crisis, with economic growth expected to average just 2.4% over the next four years.

Economic growth in this recovery is a third slower than in the recoveries of the 80s and 90s while job and wage growth has also been dismal. And despite all the spending cuts they’ve made, we also can’t expect the federal government to have much extra money because the additional tax cuts they’ve promised are eating up a lot of the surplus.

If we have a balanced budget and federal taxes have been cut to the lowest share of the economy in 70 years, why is out economy growing so slowly? It certainly isn’t because interest rates are low: instead they’re close to historic lows, so low they could fuel another asset boom and bust. It isn’t because businesses lack money to invest: they have a record $600 billion of excess cash they aren’t investing in the economy. It isn’t because we’re lacking labour: there are over 1.2 million officially unemployed with hundreds of thousands more underemployed.

So if everything is in place according to the Conservatives’ economic ideology—balanced budgets, low taxes, low interest rates, corporations flush with cash, excess labour, free trade, low wage growth—why does the economy suck?

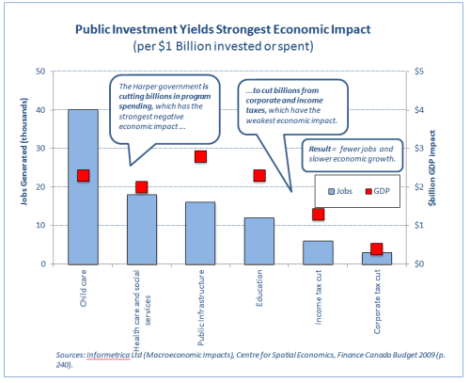

The answer is right under Joe Oliver’s nose, in his department’s publications and media releases—and is illustrated with the chart below.

In his Economic and Fiscal Update (and in many of his recent public announcements) Oliver boasts about how much the Harper government has cut federal government spending and how much they’ve cut taxes. The EFU emphasizes how they’ve balanced the budget by cutting program spending “Federal direct program spending has declined for four consecutive years, a trend that has not been achieved in decades†while also cutting taxes by billions, including through income splitting. In fact the EFU illustrates (on page 63) that under the Harper government’s plans, federal program expenses as a share of GDP will fall to an historic low.

But the following chart (based on “economic multipliers†from Finance Canada and two highly respected private sector economic analysis firms) shows that public spending has a much stronger impact on the economy than tax cuts do. This means that cutting public spending while also cutting taxes will lead to slower economic growth, higher unemployment and lower wage growth.

For instance, if the federal government cuts $1 billion from health care and social services, it will lead to a loss of an estimated 18,000 direct and indirect jobs and a decline in the economy of $2 billion.  Meanwhile an income tax cut of $1 billion will only generate an estimated 6,000 jobs and boost the economy by $1.3 billion.  So if the government cuts spending by $1 billion while also cutting income taxes by $1 billion, it will lead to a net loss of -12,000 jobs and a net decline in the economy of -$0.7 billion.

For instance, if the federal government cuts $1 billion from health care and social services, it will lead to a loss of an estimated 18,000 direct and indirect jobs and a decline in the economy of $2 billion.  Meanwhile an income tax cut of $1 billion will only generate an estimated 6,000 jobs and boost the economy by $1.3 billion.  So if the government cuts spending by $1 billion while also cutting income taxes by $1 billion, it will lead to a net loss of -12,000 jobs and a net decline in the economy of -$0.7 billion.

Investments in childcare have the strongest impact in terms of jobs and one of the strongest in terms of economic growth while corporate tax cuts have the weakest impact. When the economy is suffering from deficient demand, as it is now, these differences are magnified even more than the multipliers below show.

Our economy doesn’t suck because we suck.  Canadians are skilled, hardworking, conscientious and productive (and, yes, polite too). Our economy sucks because our federal government’s economic policies suck—and it just might be time to do something about it.

You’re my hero. I’ve been wanting to put the lie to Harper’s official message that they are master stewards of the economy. They are anything but. At the federal level, inflation-adjusted, since 1950, Conservative governments average annual expenses in raw form, as a % of GDP, and per capita, are 49%, 13%, and 33% higher, respectively, than Liberal governments. Conservatives have been in power 35% of the time since 1919, yet account for 45% of accumulated inflation adjusted expenses. Which is remarkable, considering the astronomical expenses accumulated during the Liberal government of the World War II years. Looking at all party changeovers since 1950, Liberal to Conservative changeovers lead to average increases in expenses of 10.8% while Conservative to Liberal changeovers lead to average DECREASES of 16.4%.

Don’t mention multipliers around “experts” like Andrew Leach or Stephen Gordon. They will either say you can create more jobs with a bucket brigade (how clever!) or that they want a unicorn.

But the reason the economy was so strong in the post-war Keynesian era (1945-1980) is because we had progressive taxation, rising real incomes, low inequality and government influence over monetary policy.

In short, we had a democratic economy with more money in the pockets of average people. This boosted economic growth with greater spending, saving & investing.

Over the past 35 years, only the rich have benefited from economic and productivity growth. Real median earnings have actually fallen from 1970s levels. This is one of the reasons the economy collapsed again like during the 1930s.

One of the biggest problems is tax cuts that primarily benefit the rich. These are meant to bankrupt democratic government (“starve the beast.”)

In the past 15 years alone, tax cuts have cost us $90-billion a year. This just goes to show that the Conservatives are not the only low-tax, small-government party.

By denying average people their fair share of the economic pie, this has created a smaller pie.

If economic growth had continued at the 4.6% average growth rate of the Keynesian era — as opposed to the 2.5% rate of the free-market comeback (1980 to 2013) — GDP would be $3.3-trillion instead of $1.9-trillion.

So instead of a surplus of a few billion (brought about by secret cuts and spending restriction schemes,) we would have a surplus of over $400-billion.

Small government is the problem. Democracy is the best of all alternatives — and that includes plutocracy.

It seems to me that Harper is strictly looking for votes in the next election; lower taxes, cutting spending, and a host of other goodies (income splitting, trade deals, increased money for childcare) are all designed to get votes from certain blocks of voters. If he concentrated instead on creating and guaranteeing jobs for those who want to work instead of bribing the electorate with “goodies,” then we would really feel some economic changes.

Given the price of oil has dropped below $70 today, I think you may want to add another graph to this presentation.

Is it time now to recall what we have been stating on here back to 2007- that putting all our economic development eggs into the tar sands would be a massive gamble- and cost Canadians more than Harper could ever comprehend in his quest to rise Alberta to a new land of prosperity at the expense of manufacturing and the rise in the dollar?

Is it not time the opposition parties started up with an economy strategy that basicaly corners Harper into his Tar sands sand box? He cannot get out of this one- and sadly if we see the energy sector meltdown- without a corresponding response in other economic areas-then we could see blow back into the housing sector. This could be the breaking point of the economy- as it was a delicate balancing act of many prevailing dynamics keeping the housing sector strong as the main drivier of non-oil provinces- but mainly consumer debt. So we could see the housing sector get just enough of a push off its summit, and the slide could begin, which will cost us.

Seems like a precise point for the opposition parties to attack Harper and distance themselves from the tar sands support.