Canada’s (not so incredible) shrinking federal government

Buried in the federal government’s recent Update of Economic and Fiscal Projections are figures showing the Harper government is set to squeeze federal government’s role to the smallest it has been in seventy years.   (Bill Curry at the Globe also just wrote about this, but without figures further back than 1958).

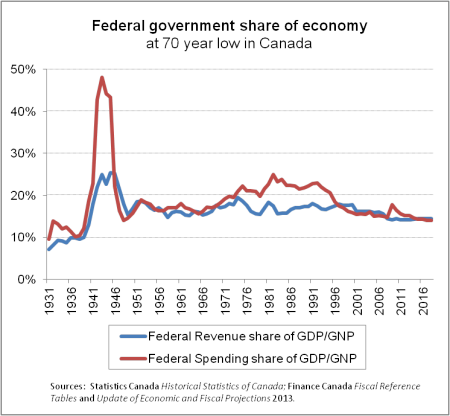

Total federal government spending as a share of the economy is projected to drop to a 14% share of the economy by 2018/19. Â This would be the lowest since at least 1948. Â Because the government has tied the federal public service up in knots, actual spending will likely continue to be even lower than planned. Â And if the Harper government follows through with its plan to allow income splitting for tax purposes and to increase the annual limit for Tax-Free Savings Accounts, revenues will be even lower.

The Harper government has already cut overall federal taxes and other revenues to the lowest rate they’ve been in over 70 years. Â Total federal revenues as a share of the economy declined to 14% in 2012/13, with tax revenues down to 11.5%. Â The federal government’s revenues and taxes haven’t been this low as a share of the economy since 1940.

That’s before Canada had national public health insurance, the Canada Pension Plan or unemployment insurance. Â If revenues and spending associated with these are excluded, we have to go even further back to find a period where the role of the federal government in Canada was so diminished.

While the federal government’s tax revenues have declined as a share of the economy, many Canadians might not feel any better off, or more lightly taxed. Â That’s because there’s been a major shift in where the federal government gets its money.

Tax rates on top incomes and corporations have been cut, while the use of tax loopholes and tax havens have proliferated.  The conversion of retail sales taxes to value-added taxes such as the GST/HST has shifted the costs of these taxes to consumers and away from businesses.  And with downloading of responsibilities to provinces and municipalities, these levels of government have relied on increasing more regressive taxes.   Our tax system has become so regressive that the top 1% pays a lower overall rate of tax than the poorest 10%.

The federal government’s revenues have increasingly shifted towards personal income tax (PIT). Â For the first time ever, personal income taxes are projected to provide more than 50% of Ottawa’s revenues next year in 2014/15, and keep rising. Â That’s up from a 30% share fifty years ago and even lower shares before then.

What’s come down is the share of the federal government’s revenues paid by corporations as well as other taxes and duties. Â These include estate taxes, excise taxes and custom duties. Â Despite record profits, corporations provide just 13.6% of the federal government’s revenues in corporate income taxes. Â That’s a third less than the over 20% share they provided during the “Golden Age of Capitalism” from 1946 to 1970.

If the federal government’s revenues were just at its post-war average of 16.8%, it would have $48.7 billion more in revenues this year and $55.8 billion more in 2018. Â This would provide more than enough money to eliminate the deficit and fund important social programs. Â While some politicians and business lobby groups will always claim otherwise, it’s clear the federal government doesn’t have a deficit because of any spending problems, but because its revenues are low.

What taxes would be best raised for additional revenue?  First close unfair tax loopholes and access to tax havens that primarily benefit wealthy individuals and corporations.  Not only do these erode federal tax revenues, but they also siphon money away from provincial governments.  Next the federal government should increase corporate and high income tax rates.  These measures alone would bring well above $20 billion annually.  Please support the campaign of Canadians for Tax Fairness to close some of the most egregious tax loopholes.