Excerpts From CAW Convention Document

Last week’s CAW convention in Toronto was one of the most exciting labour events I’ve ever been to. A highlight, of course, was the high-energy and unanimous endorsement delegates provided for the New Union Project (under which the CAW and CEP will jointly form a new union, with a new name and hopefully a new image in the eyes of non-union workers). If CEP delegates also back the idea at their convention in October, then the project would move ahead to fruition presumably sometime in 2013. We had a great rally for locked-out CEP members at Bell, blocking off Adelaide Street in downtown Toronto. We had a fascinating and inspiring range of speakers, including: Parliamentary Budget Officer Kevin Page (who gave a strong presentation about how Canadians do have fiscal choices, and should exert their democratic authority over the budget process); Stephen Lewis; Ken Georgetti; Dave Coles; Paul Moist; Julia Pope from the wonderful activist network LeadNow; and of course Mark Carney. Delegates came out of the convention hopeful and energized, which is a refreshing change from the defensiveness many have felt these last few years.

The “bread and butter” business of the convention involves electing our leadership, voting on any constitutional changes, and adopting the Collective Bargaining and Political Action Program which is meant to guide the union’s activism over the next three years. This document is an important reference regarding current practices and goals across the whole range of bargaining subjects (wages, pensions, benefits, work time, restructuring, and more). It opens with an overview essay which summarizes the current economic and political environment and sets the stage for the labour movement’s work. Delegates also received a set of 18 different sector profiles, summarizing the economic and policy context in each of the major sectors where a critical mass of CAW members is represented.

All of the convention materials (including the sector profiles) are now posted here. That site also provides videos of the major speeches. The detailed paper on the New Union proposal is available here.  What follows below is an excerpt from the Economic and Political Overview, including some of the relevant graphs, to give a sense of the analysis.

*Â Â Â Â *Â Â Â Â *Â Â Â Â *Â Â Â Â *

Crisis, Austerity, and Resistance: Trade Unionism After the Meltdown

(Excerpt from CAW Collective Bargaining & Political Action Program, 2012)

An Upside-Down World

If there was ever a moment in history when the rich and privileged of society should be on the defensive, it should be right now. The whole economic and political regime which they’ve been constructing for the past three decades has proven incapable of managing the pressures and problems of the modern economy. And their fundamental promise that everyone would share in the “trickle-down†benefits of prosperity, if only we tighten our belts and get the “fundamentals†in place, has been proven utterly false.

The painful irony, however, is that these same entrenched forces, who profited so richly while the “bubble†was expanding, are now taking advantage of the current grim political and economic environment to reinforce their own power and privilege. They are the ones – financial wheelers and dealers, ruthless global corporations, and the conservative politicians who do their bidding – to blame for the widespread human hardship we see in Canada, and around the world, every day. They are the ones who should have egg on their faces. Yet instead of acknowledging their individual or collective responsibility, they blame the victims. And instead of fundamentally changing direction in the wake of these spectacular failures, most governments (including Canada’s) have become all the more committed to the path of neoliberalism

The worse global capitalism performs, the stronger and more aggressive its proponents seem to become. It truly is an upside-down world.

It’s our responsibility as trade unionists, committed to progress both at the bargaining table and in broader society, to help turn the world rightside-up. We can do that, with our passion and our power.

The Self-Defeating Logic of Austerity

Europeans have endured the most extreme form of fiscal austerity. But the temptation to deeply cut government programs (something that conservatives and business lobbyists always favour, no matter what the state of the economy or the budget) has spread to other jurisdictions, as well. In fact, whether these was a deficit or not, conservatives would still be taking advantage of any excuse to get rid of public programs they always hated anyway.

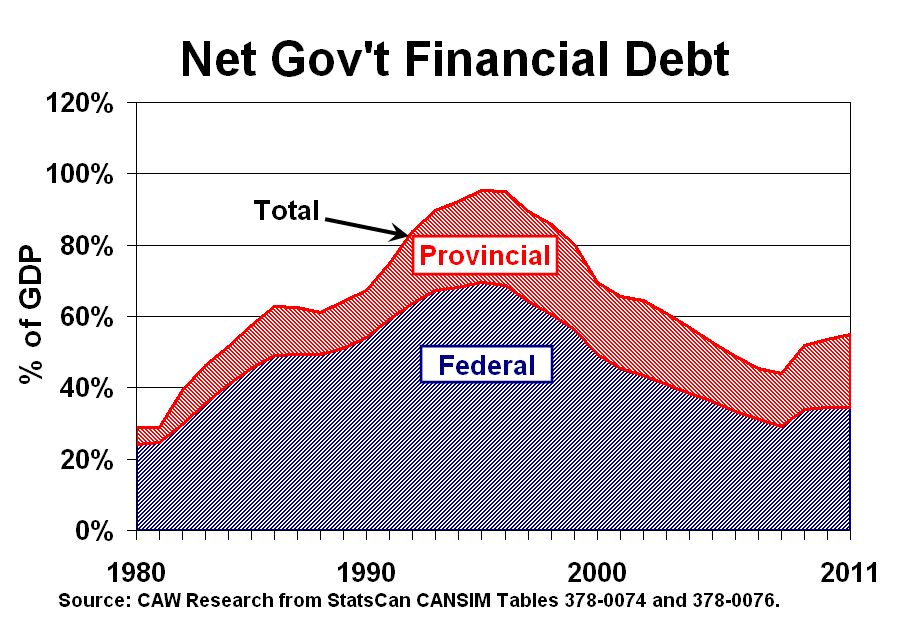

Here in Canada, where deficits are much smaller, governments at all levels (federal, provincial, and municipal) are targeting public programs, and public sector workers, with deep cuts – all justified by an exaggerated fear of the deficit. Canada’s deficits are much smaller than those in other countries, and much smaller than the deficits we experienced in previous years. Figure 1 illustrates the course of public debt in Canada, measured (appropriately) as a share of our GDP. While the debt burden bounced up a bit after the 2008-09 recession, it is still far lower than in the 1990s, and not remotely high enough to cause major financial worries. And the fact that interest rates remain very low (precisely because of the continuing global crisis) means that government interest costs have actually declined (as a share of GDP) despite the modest rise in debt.

In short, there is no fiscal emergency in Canada, contrary to the alarmist cries of those who would take this opportunity to dramatically scale back government programs (like public pensions, EI, and health care) which they have been itching to downsize for decades. In fact, when the overall economy is stuck in the doldrums, it actually makes sense to tolerate a deficit: it supports spending and jobs that otherwise would disappear, making the recession even worse.

The efforts of conservatives to take advantage of the economic crisis to fundamentally reshape our social policies and public services is another clear example of “shock doctrine†strategy. For example, Prime Minister Stephen Harper announced that Old Age Security payments would be delayed for two years, not starting until age 67. He claimed this was necessary to reduce the deficit – even though the federal government’s budget will be balanced in 2015, long before the OAS changes take effect – and even though a whole parade of financial experts (from the government’s Chief Actuary to the Parliamentary Budget Officer to the OECD) affirmed that Canada can certainly afford our existing public pensions. Nevertheless, the government rolled back OAS anyway – effectively stealing two years of Canadians’ “golden years,†all justified by a non-existence fiscal “crisis.â€

We emphatically reject the idea that Canadians can “no longer afford†essential public programs and services, that we built (and paid for) in previous decades when our economy was not nearly as productive or wealthy as it is now. The current deficits of the federal and provincial governments are modest and manageable. Until the underlying economy regains momentum, deficit-reduction should not be the priority. Rather, governments should focus first on putting Canadians back to work. When they are once again generating income and paying taxes, then we’ll be fully able to pay the full costs of our essential public programs.

Capitalism’s Missing Engine

The whole theory of “trickle-down†economics, so central to neoliberalism, is that by getting the “fundamentals†right and creating a very favourable, pro-business climate, the entrepreneurial spirit of private businesses will be unleashed. The resulting wave of investment (including from foreign investors flocking to take advantage of attractive profits and taxes) will create new work, and new wealth, that will eventually be shared by those lower down the economic ladder.

This theory has many flaws. Even when the economy is booming, there is no guarantee at all that the benefits will be shared throughout society. That’s why unions are so essential. Without them, workers have little chance of capturing a fair share of the wealth they produce.

However, in recent years the logical chain of trickle-down theory has been broken right at the first link. Despite policies that have created an enormously favourable business climate, the actual economic effort of private corporations has become weaker, not stronger. Thanks to lower business taxes, restrained labour costs, and very high commodity prices, corporate profits in Canada have never been higher (measured as a share of GDP). Yet business capital spending, even before the financial crisis hit, was not strong. And since the recession, private business investment has been the slowest segment of the domestic economy to rebound. Even by the end of 2011, business investment spending was still lower than before the recession hit. Business commitments to R&D and innovation fared even worse: relative to GDP, Canadian companies now spend one-third less on R&D than before the turn of the century.

What’s happening to those record-breaking profits, if they are not being reinvested in new job-creating projects? Some is paid out to shareholders in large dividend payouts. Some is shifted to capital investments in other parts of the world. Much of it, incredibly, is sitting in an enormous pile of idle cash, hoarded by private companies who literally are making more profit than they know what to do with.

Figure 3 illustrates the hoard of cash and short-term assets held by non-financial corporations in Canada (not counting the enormous cash reserves of banks and other financial institutions). By the end of 2011 non-financial companies were sitting on almost $600 billion in idle cash. In contrast to debt-strapped consumers and governments, corporations actually added to their cash stockpiles right through the recession.

Just imagine the energy that could be unleashed in Canada’s economy if corporations actually spent their money here, instead of sitting on it. The failure of private businesses to reinvest their record earnings casts particular doubt on the wisdom of the large cuts in corporate income taxes that were implemented by the federal and most provincial governments, despite recent deficits. Effective corporate income taxes have been cut by more than one-third in Canada since 2000, cuts that now cost our governments over $25 billion per year in foregone revenues. The impact of those tax cuts on investment spending has been non-existent. We’d be much better to take those funds and invest them in public infrastructure and transportation projects, rather than waiting for an elusive boom in private activity that never seems to arrive. Tax incentives should be targeted at companies that actually increase investment in Canada, rather than wasted on across-the-board tax cuts that reward idle cash hoarding.

Canada’s Regressing Economic Structure

The only part of Canada’s economy where private companies are showing any dynamism at all is in the area of resource extraction – especially petroleum. High world oil prices, combined with very low royalty and tax rates and our government’s unique willingness to sell off resources to global corporations, have all unleashed an unprecedented boom in mining and petroleum. The boom is centred on the bitumen reserves buried in northern Alberta, but some other resource regions have also expanded.

Of course, Canada has always been a major resource producer, and resource industries have the potential to add significantly to our employment and our prosperity. However, there are important costs associated with resource industries that must also be considered, and managed, to ensure our resources are developed in a manner that maximizes net benefits to Canadians. In particular, we must be concerned with:

- Controlling resource developments in order to minimize environmental damages.

- Ensuring that maximum employment and economic opportunities associated with resource projects are available to Canadians, including equity-seeking groups (such as aboriginal communities).

- Ensuring that the overall pace of resource development is managed to avoid inflicting harm on other parts of the economy (through inflation, regional imbalances, and exchange rate effects).

- Limiting the control and profits of foreign corporations in Canadian resource developments.

On all these criteria, the “hands-off†approach of the current federal government is causing significant damage and dislocation. The petroleum industry, dominated by foreign firms, has been given free license to develop resources (especially bitumen deposits) as quickly as possible. There is no restriction on foreign ownership, nor on the export of unprocessed resources. Resource exports have grown, but everything else that Canada produces for the world economy (including manufacturing, tourism, and services) has declined. Our trade balance has crumbled, even as foreign capital rushes in. Structurally, we are more dependent on the export of raw resources than at any time in recent decades.

For example, Figure 4 illustrates the proportion of total Canadian exports consisting of basic resource-based products. This reliance on resources declined from the 1970s through the 1990s, as our value-added industries (like auto, aerospace, and telecommunications equipment) thrived. Since the turn of the century, however, Canada has been quickly reverting to its traditional economic role as a supplier of “staples†products to the rest of the world. Last year almost two-thirds of Canada’s merchandise exports consisted of unprocessed or barely processed resource-dependent products – compared to just 42 percent in 1999 (when our value-added industries were at the top of their game).

This is a very dangerous long-run trend, with enormous economic, environmental, and geopolitical risks for Canada. True success in the modern global economy requires much more than extracting whatever lies buried in the ground beneath our feet. Rather, we need a strategy to build a diversified, value-added economy, one that relies on our creativity, our labour, and our innovation – not just on our natural resources.

A particular concern has been the impact of the petroleum boom on the Canadian currency. Even though the petroleum industry makes up less than 3% of Canada’s GDP, and even though our overall trade balance has gotten worse (not better) during the bitumen boom, currency traders now treat Canada’s loonie as a “petro-currency.â€Â They have driven the dollar far above its fair trading value. (Based on relative prices and costs, economists at the OECD and the IMF think the true value of our dollar should be about 81 cents U.S.) This has caused enormous pain in all other export-sensitive industries, including manufacturing, tourism, and globally traded services (like transportation). It’s not just manufacturing firms in Ontario that have suffered. Even in Alberta, at the epicentre of the boom, manufacturing jobs have disappeared by the thousand, squeezed out by the artificial impact of an inflated currency.

The CAW has always campaigned for sector-focused economic strategies aimed at pro-actively supporting investment, technology, employment, and exports in key industries. While we recognize the potential benefits of both foreign investment and resource developments, we have also always recognized the need to strictly control those flows to produce net benefits for Canadians. Similarly, while we agree that international trade can open up great economic potential (especially in specialized high-tech industries), that trade must be managed to ensure it occurs on a mutual, two-way basis – in contrast to current free trade agreements, which do no such thing.Â

Recent international experience has shown that the most successful countries – including Germany, Korea, Scandinavia, Brazil, and China – are those which embrace pro-active sector and industrial strategies. In contrast, those economies which simply open up to foreign capital, and then wait for the private market to work its magic, have been afflicted by deindustrialization and speculation, rather than real investment and development. Sadly Canada falls into that latter category, and will stay there until we take a more pro-active, hands-on approach to developing our economy and its major industries.

A Progressive Economic Alternative.

The federal and provincial governments, major business sectors, labour, and other economic stakeholders must meet in a national summit to implement a National Jobs Strategy to put Canadians back to work. That must be the first priority in repairing our economy, and our government budgets.

Part of the National Jobs Strategy must be sector-specific, focused, well-resourced industrial strategies to develop the key sectors in our economy. The goal is to expand Canada’s share of high-value, high-productivity, high-technology goods and services – everything from sophisticated manufacturing to high-value tourism to high-quality services (like transportation, communications, education, and others).

An overarching goal of economic strategy must involve more carefully regulating resource industries, and taking active efforts to maximize Canadian value-added opportunities associated with resource extraction. This includes targets to boost Canadian content in input industries which supply our resource sector (with equipment, materials, and services), as well as strategies to boost Canadian processing and manufacturing of our resources (rather than exporting the raw product).

Another theme throughout our jobs and sector strategies must be maximizing economic opportunities from the “greening†of our economy. Hundreds of thousands of good jobs could be created and supported through massive investments in green energy, energy-efficient transportation equipment and transit systems, energy conservation initiatives in buildings, and the clean-up of pollution.

In order to ensure that real investment and production takes precedence over financial speculation, Canada needs a more aggressive effort to rein in the financial sector. This must include stricter rules on Canadian banks to ensure their unique economic powers are used for the benefit of the real economy. It can also include the greater use of public or non-profit banks (including public lending agencies, like Business Development Canada, and credit unions). We support the formation of a publicly-owned national development bank (similar to those in Asia and Europe) to direct lending toward real investments in key sectors and regions.

Unions and collective bargaining are essential in order to ensure that the benefits of economic growth are indeed shared with those who do the work. Labour laws in all jurisdictions must be improved to sustain and expand collective bargaining (including through measures like card-based certification, first contract arbitration, and sectoral bargaining structures). Universal labour standards (such as higher minimum wages, pay equity, and stronger regulations governing employment contractors and agencies) will also help to ensure that all Canadians benefit from economic recovery.

A Progressive Fiscal Strategy.

Canadians can enjoy high-quality public services and social programs, and pay for them – but only if we are back at work, generating income and paying taxes (instead of being unemployed). The best medicine for Canada’s current deficits is to focus on job-creation and economic growth, through the measures outlined above. Short-sighted austerity would undermine job creation, making the underlying problem worse.

Fiscal support for our public programs has been undermined in recent years by ill-advised tax cuts which disproportionately benefited corporations and by high-income households. We support increasing corporate tax rates; fiscal incentives for real capital investment can be better delivered through targeted measures (like investment tax credits). Income taxes should be increased for very high-income households, too – as occurred recently in Nova Scotia and Ontario.

The financial meltdown and its aftermath have added to the woes of Canada’s pension system. Many defined benefit plans are in deficit; those with defined contribution plans fare even worse. Public pensions are the fairest, most secure, and most efficient way to provide decent pension income; these plans should be expanded. We support the CLC’s campaign to double the level of benefits paid out under the CPP (supported by a commensurate increase in CPP premiums). The qualifying age for OAS benefits should be kept at 65, and GIS benefits expanded for low-income seniors.

Canada can afford to preserve existing public programs (including health care), just by putting Canadians back to work. We can also work toward the expansion of public service delivery in key areas – such as accessible public early childhood education programs, elder-care initiatives, and a national pharmacare system. The incremental cost of new programs can be covered through new tax sources, including the corporate and high-income taxes noted above.

A Progressive Global Agenda.

The Harper government’s current onslaught of free trade agreements (they are currently negotiating 18 different free trade deals!) must be stopped. These deals (including huge ones like the comprehensive economic pact with Europe, and the Trans Pacific Partnership deal with the U.S. and Japan) would lock in the current business-dominated approach to our economic development.

Even our existing trade deals need to be fundamentally reformed; they have contributed to Canada’s deindustrialization and our growing national trade deficit. As a first step, NAFTA’s anti-democratic Chapter 11 (which grants special powers to foreign companies to sue Canadian governments, through an exclusive kangaroo-court system) must be abolished.

Many CAW members work in industries which were built through foreign investment, and we understand well that foreign investment can be a valuable, productive force in our economy. However, throwing open the doors to any and all takeovers has been a disaster for Canada. Investment Canada has approved 1664 out of the 1666 foreign takeovers it reviewed since 1984, when Brian Mulroney’s government abolished the former foreign investment review process. And that doesn’t include tens of thousands more takeovers which weren’t even scrutinized – including Caterpillar’s devastating takeover (and subsequent shutdown) of the Electro-Motive plant in London, Ont. The whole Investment Canada process needs to be reformed, to close loopholes, provide for genuine input from all stakeholders, and allow governments to enforce commitments from acquiring companies.

In general, the principle that global companies can do whatever they want, yet are still guaranteed unconditional access to markets and profit opportunities, must be challenged and rolled back. The Caterpillar experience provides another dire warning: this company invaded London, took over a successful plant, extorted the workers and their community, and then left. Yet Canada still allows Caterpillar to make billions of dollars of profit here, including through our own non-renewable resource industries (which buy billions in Caterpillar products and services). This is outrageous. When a company mistreats Canadians, it must pay a price – otherwise others will behave the same way. A creative, determined government could hold companies like Caterpillar to account – free trade agreements notwithstanding.

The Power of the People

There’s no doubt about it: We face a very daunting economic and political environment. Times are tough everywhere. People have lost so much – and worry about losing more. Entrenched powers take advantage of that fear to ram through further austerity and belt-tightening, using “shock doctrine†strategies to their advantage. Corporations and investors, despite their complicity in causing this crisis, use their political influence and their global mobility to punish those who try to rise above self-defeating austerity and a race to the bottom that only benefits employers.

In the face of these uneven odds, however, what is especially inspiring is the continuing willingness of people around the world to stand up in defence of their economic interests and their political rights. The years since the financial meltdown have not only been marked by continuing corporate greed and attacks on working people. They have also been defined by resolute efforts on behalf of common folk to speak out and build a better world.

Consider just some examples of the courage and determination of people, against the odds, coming together to demand fairness and democracy:

The Occupy movement sprang to life in autumn 2011, inspired by a call (from Canadian journalist Kalle Lasn) to symbolically occupy the space (Wall Street) where the whole financial crisis started.

Another stunning example of grass-roots mobilization was provided by the student movement in Québec.

In Europe, attempts to use the fiscal crisis to dismantle long-standing social protections and programs have been resisted courageously, even amidst a dire economic meltdown. Unions and other progressive forces in Greece, Portugal, Spain, and other countries have campaigned actively and militantly against the anti-democratic, self-defeating cutbacks being imposed by the EU and the IMF. In Ireland and the U.K., too, general strikes and other mass protests have resisted the austerity measures of governments in those countries. In Iceland, mass protests led to a total change in that country’s political and financial direction. Through this sustained and courageous activism, European unions and their allies have forced the system to consider other solutions. If they had bent to demands for austerity, then the bankers and speculators who actually caused the crisis would now be laughing all the way to the bank.

In other parts of the world, too, the power of mass protest to effect dramatic change has also been reaffirmed in the years since the financial meltdown. Most dramatic, of course, has been the so-called “Arab Spring,†in which popular mobilizations (motivated by a complex mix of economic, religious, and social grievances) unseated long-standing authoritarian governments. What comes next in these countries is not clear. Elsewhere, too – from Russia to Indonesia to South Africa to Thailand to Argentina – mass movements for change have curtailed the actions of regressive governments, and strengthened the hand of progressive ones.

So while we lament the needless economic and social pain that has been experienced around the world (including Canada) since our last convention, we are equally inspired by the willingness of large numbers of people to stand up and demand something better. Indeed, this continued hope and activism reveals a fundamental truth we can count on, as we keep stubbornly resisting what is happening: So long as people are exploited and oppressed, they will find ways to resist and fight for change, until we reach a more peaceful and sustainable social condition.

As a democratic and independent voice of those who work for a living, trade unions have a crucial, historic role to play in that unstoppable social evolution. We recommit ourselves to fulfilling that role, as much as our skills and courage allow us.

Great post Jim, I have to say I watched the livestream and it was a very uplifting conference filled with so many passionate people and speeches.

I did not realize you were into Hip Hop, damn even my son watched the Hip hop thing and kept asking me to replay that part. He was signing the tune hours later with your version of the lyrics! lol.