Labour Market Exodus and Other Unhappy Math

Friday’s labour force survey numbers from Statistics Canada were another nail in the coffin of Canada’s fleeting, fragile economic “recovery.”

On first glance, the data seemed to tell a good story: the official unemployment rate tumbled from 7.9% to 7.6% in November. Immediately, that seemed strange — given that 0nly 15,000 jobs were created for the month. Worse yet, full-time employment declined (slightly more than offset by part-time gains), and private sector employment also declined (slightly more than offset by stimulus-fueled public sector hiring). So how the heck did the unemployment rate fall by a third of a percentage point?

A whopping big reduction in labour force participation was the sole factor driving the drop in the official unemployment rate. Labour force participation (the proportion of working age adults either working or “actively seeking” work) fell by three-tenths of a percentage point in the month. That’s a very dramatic decline in an economic indicator that usually changes only very gradually; in fact, it represents the biggest one-month decline in the participation rate since November 1995.

November’s exodus continued an erosion in labour force participation that began even before the official recession hit. From a peak of 68% in March 2008, the rate has now declined to 66.9%. Falling participation is a common symptom of prolonged labour force weakness. Workers aren’t irrational: if there are no jobs, they won’t bother “actively seeking” them (at least not to the standards that pass Statistics Canada’s threshold for being included in the “labour market”). But withdrawing en masse from the labour market has enormous implications for individuals, families, and communities. A process of hysteresis quickly sets in, whereby lives are changed and economic doors are closed for many years to come.

So this accelerating exodus from the labour market spells long-term bad news for the ability of Canadian families to produce value-added and support themselves and their communities. But it is ironically “convenient” for purposes of reducing the official unemployment rate. Thus Mr. Harper and Mr. Flaherty will continue boasting that Canada’s labour market is strong relative to those jurisdictions with higher unemployment rates (like the U.S.). This knee-jerk claim (that things may be bad here, but they’re worse someplace else) rings increasingly hollow as Canada’s recovery remains stuck in the mud … while those in many other countries actually gather steam.

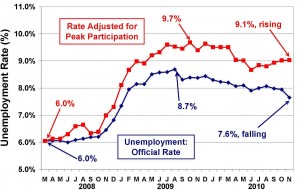

Figure 1: Official and Adjusted Unemployment

Â

Â

Â

Â

Â

Â

Indeed,there’s no sign of recovery at all visible in the latest labour market numbers. Consider the following:

- Without the decline in labour force participation since 2008, Canada’s unemployment rate today would be 9.1%, versus the official 7.6%. Figure 1 compares the path of official unemployment, versus unemployment adjusted to reflect the fall in participation. (And this adjustment doesn’t take account of involuntary part-time workers — another key source of “hidden unemployment.” If we included them, unemployment would be in double digits.)

- Worse yet, by this adjusted measure, the unemployment rate has been rising since June, when job-creation hit a brick wall. That’s not what happens in a recovery.

- In the last five months, total employment has declined by 10,000 positions.

- Including Canadians who have left the labour market, this broader definition of unemployment would include 1.71 million unemployed. That’s only marginally better than the peak level of 1.80 million reached in October 2009 — and still miles away from the pre-recession low of 1.09 million in February 2008.

- Incidentally, only 514,000 Canadians were receiving regular EI benefits in September (latest data available).

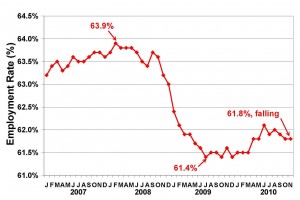

At times when participation rates are unstable (like right now), the employment rate is a better indicator of genuine labour market vitality than the unemployment rate. The employment rate (the proportion of working age adults actually employed) simply tests whether someone is working or not; it avoids entirely the now-academic distinction whether they are seeking work sufficiently actively to qualify for labour force membership. The employment rate in November was 61.8%, and it too has been falling since June.

This gives the lie to the oft-repeated claim that Canada’s labour market has now completely recovered from the recession — since, after all, total employment has regained its pre-recession level (17.2 million). This claim ignores the fact, however, that Canada’s working age population has grown by about 1 million since the recession began. So just getting back to the same number of jobs that prevailed in spring 2008 is hardly sufficient for a recovery, in a labour market that needs to be growing all the time just to keep up with population growth (let alone to absorb the swaths of excess supply that are currently visible).

Figure 2: Employment Rate

Â

Â

Â

Â

Â

Â

The peak employment rate reached before the recession was 63.9% (in February 2008 — see Figure 2). At the trough of the recession (July 2009) it had fallen to 61.4%. Today it is 61.8%. Far from fully recovering to pre-recession conditions, Canada’s labour has actually repaired less than one-sixth of the damage (0.4 percentage points out of the total decline during the recession of 2.5 points). Figure 2 looks more like the infamous “dead cat bounce,” than a true labour market recovery.

Consider further that Ottawa estimates (in its 6th report on the Economic Action Plan) that almost 200,000 jobs have been created or saved as a result of stimulus program spending by all levels of government. I think that’s a broadly reasonable estimate, frankly. [The Parliamentary Budget Officer (Kevin Page) and some opposition politicians have been disputing it. But Page’s methodology for questioning the number was bizarre: a survey mailed to companies which performed stimulus-related work, asking whether they thought the program was helping or hurting unemployment. That’s no basis for an analysis of whether or not that spending actually produced work (directly or indirectly).]

Here’s the problem for Ottawa, though. If we take away those 200,000 jobs, then the official unemployment rate today would be 8.7% (as high as it got during the recession). And the broader measure (counting discouraged workers) jumps to over 10% — higher than its recession peak. In other words, without 200,000 stimulus-fueled jobs, Canada’s labour market has not rebounded at all from the darkest days of the crisis. We are thus in no position to handle the disappearance of 200,000 jobs, but that’s exactly what will happen if the stimulus money is phased out before there’s a significant rebound in private sector spending and hiring.

Combined with other evidence of the sudden screeching halt of Canada’s recovery (such as it was), November’s labour force numbers should give serious cause for pause on the part of governments who are now trying to turn off the sitmulus pumps, panicked at deficits (not to mention worried about the right-wing populism which is successfully exploiting those deficits for political gain). A reduction in government expenditure and public sector employment, when private sector spending and employment is not growing and is in fact still falling, will undoubtedly throw Canada back into recession. No wonder Mr. Flaherty is already backing away from his pledge not to extend any stimulus projects (extending his earlier “firm” deadline for infrastructure spending). And he’s likely to do a lot more backtracking on this score before we’re done with this business cycle.

Keep up this important work.

If Canada sold zero-interest Treasury Bonds to Bank of Canada, and used the proceeds to buy back all out-standing “interest-bearing” Treasury Bonds, the immediate annual savings of $58,000 million (StatsCan) would handily pay down the national debt.

Well, the American Monetary Institute has historical proof that this can be done….

SO… why aren’t the Canadian Labour Unions protecting jobs by using the slogan: “Cut Interest, Not Services” ????????????????????????????????????????????????????