Upstream Supply Chain as Sector Development Strategy

My column in Wednesday’s Globe and Mail suggested that Canada implement a “Buy Canadian” strategy associated with major natural resource developments, with the goal of enhancing Canadian content in the overall value chain. Can we utilize our strong foothold in resource extraction, and try to leverage greater investment and value-added upstream in the value chain (for example, by stimulating more purchases of Canadian-made mining equipment)?

A related (and more familiar) priority would involve trying to stimulate more Canadian content downstream in the resource value chain — by stimulating more Canadian activity in the work of processing, refining, and otherwise adding value to the resources that we produce. Limiting exports of raw logs, bitumen, and fish, and requiring their processing in Canada, has been a long-standing preoccupation in Canadian industrial policy discussions.

Given the importance of mining in Canada’s current economic trajectory, it would seem to make sense for Canada to target mining equipment and other supply inputs as an industry in which a home-market effect could give the sector a head start. That home-market advantage can be experienced in various ways. The machine designers might be personally acquanited with the needs and constraints of their real-world applications. Geographical proximity can facilitate two-way interactions between the designers and users of the equipment. Lower transportation costs are another good reason why a domestic mining equipment sector should play a larger role in supplying our own mines.

Other economic research has indicated the possible benefits and postiive externalities associated with a strong local machinery industry. Meric Gertler’s work has emphasized the local externalities that come from proximity between machine developers and machine users. David Robinson has documented the growth and constraints of the mining supply sector in Ontario.  Daniel Poon has highlighted China’s highly interventionist initiatives in the mining and construction machinery sector as a case study in that country’s flexible and sophisticated industrial policy (see p.8 of his working paper). Heterodox theory going back to Kaldor and Verdoorn has often emphasized the importance of innovation and productivity in the machinery sector, as a key determinant of innovation and productivity in the sectors which use that machinery (and indeed throughout the whole economy).

For all those reasons, it is a remarkable failure not only that Canada’s mining machinery industry remains underdeveloped, capable of meeting only a small portion of the mining industry’s needs in Canada (let alone globally) — but, worse yet, that Canadian governments haven’t even seriously thought about how to translate our growing resource extraction industry into a larger domestic mining machinery capbility. We’ve never seriously tried to make those connections. Which explains why the vast majority of the sophisticated, expensive, high-tech equipment used in our mines is imported.Â

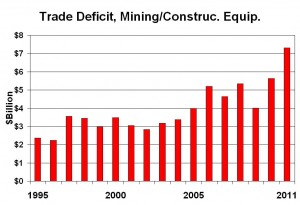

The boom in mining investment has translated into a growing trade deficit in the mining and construction equipment sector. Since 70% of this type of machinery is imported, this reduces the spin-off benefits to the Canadian economy of mining and petroleum investments (since so much of the spending injection assosciated with those investments leaks right out of the national economy). That deficit reached over $7 billion last year, more than twice its level at the turn of the century.

Companies like Caterpillar earn billions in revenue from Canadian resource developments. Yet Caterpillar is under no compulsion to produce anything in Canada. To the contrary, our governments gave Caterpillar carte blanche to take over and then shut down important productive assets. They will continue to supply our resource projects from outside the country, unless and until we implement a strategy to enhance our capacity to do this important, valuable work ourselves.

I wonder about the down-side risk of re-enforcing the significance of the resource sector. I am not saying it should not be done. But it would have to be done well.

Actually when one looks across the manufacturing landscape and the destruction, I do agree with Jim that this is a spot where we could make some value adding gains and with a whole lot of corporate leverage. In many ways, it is like a royalty tax, but in this sense they can actually profit from the guided investment.

I say if you want to extract it, use stuff built here. Sadly with the Cat plant shut down, it seems it will take another government to implement such a strategy.

It is quite a sell able strategy. I do think at least mining in its many forms will be in Canada for a long long time. Combine that with our training, knowledge and expertise, as Jim mentions, and you start getting towards filling out those industrial cluster strategies that as an innovator we could be, and I believe the downside risks are minimized as we become the center.

I also believe forestry is in the very beginning of a whole new green disruption at its very core and here I also would emphasize a similarly large effort by government to help in the renewal. Look at the Finns, there are so many innovations in this industry but we need a new corporate investment attitude than raw log exports.

I was supporting Peggy Nash on Saturday, and was a bit dismayed at the outcome. However, i must say that Tom Mulcair made a great start in question period yesterday with his focus on the Tory economic plan, i.e. de- industrialization. It was a great start to a new era. Potentially we do have to view itbthis way, there would have to be a big tent erected to get rid of Harper. The question is, where will the poles be positioned to hold up the big top. At least this way, the NDP get to decide where those poles will be, which is a much better outcome then letting Bob Rae put them up. There is a causus that will not be boot lickers like the Tory causus, and as long as that caucus can keep those poles of the tent to the left, then at least the tent is asymetric in way that maximizes the area under the curve. Its all about maximization of left space under the reality of that political curve of electiability and throwing Harper out. It has to be the objective, anything less is economic genocide for workers and their families and communities.

“It has to be the objective, anything less is economic genocide for workers and their families and communities.”

Genocide? Capitalism requires workers. No workers no profits. So the word ‘genocide’ is really silly. I get the sentiment that motivates the comment. So just articulate that.

Oh and do you imagine that a Mulcair NDP is going to change the mandate of the BOC? Do you imagine that a Mulcair NDP is going nationalize the investment function?

Do not get me wrong a national daycare plan, a robust public pension regime and some teeth in environmental policy would be a much improved Canada. But these are all middle class values and have little bearing on 65% of the labour market.

Social democracy has become the politics of catering to 35% of the labour market with some Dickinsonian bones thrown to the other 65%. And while I am glad they at least acknowledge the 65% exists their discursive totems like ‘the knowledge economy’ make it sound as though the 65% is really 15% of the labour market.

“Captialism requires workers. No workers no profit.”

Are you sure? Before the crash, a lot of profit was made on dirivatives without requiring any workers.

I stick with genocide, from a Marxian perspective

http://hcexchange.conference-board.org/blog/post.cfm?post=428

How come Canadian business interests rarely make such recommendations?