A Short History of Fiscal Constraint

As the budget yak-fest approaches, the focus is on how we’re going to balance the books. People pointing out we have bigger fish to fry – like making a dent in the nation’s $125 billion infrastructure deficit, addressing growing poverty, or preparing for a massive wave of retirements – are viewed as off-topic. But simply balancing the books is what’s off-topic. The job of government is making sure short-term concerns don’t destroy our long-term opportunities. Tepid recovery and urgent human needs demand more government intervention, not less.

Think we can’t afford any more federal action? Think again.

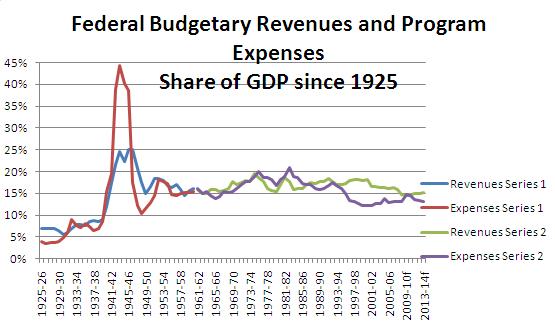

The graph below puts the current fiscal squeeze in context, and makes it, um, graphically clear how much room we have to move without “crowding out†growth. Though the federal share of economic output has nudged up slightly during the recession, the plan is to wrench it right back down again – to historically low levels. Small government may be the policy fetish of the day but – as the graph shows — that’s an ideological choice. It’s not like we can’t afford the world we want.

The second series is from the publicly available Fiscal Reference Tables (FRT), the first from an unpublished historical series provided by the folks at Finance a few years back. The two series overlap between 1961-62 and 1999-2000. I’ve only pasted in the FRT series. Data geeks may find the differences interesting (and for those who don’t, skip to the next para). Until the late 1960s there was almost no difference between the two series. Between the late 1960s and early 1980s, the FRT consistently shows federal spending and revenues as a higher share of the economy, with the difference as much as a 2% of GDP more by the early 1980s. From 1983-4 (when full accrual accounting came into play) to 1992-93 the two series are very close on revenues, but spending is a lower share of GDP. By 1993-94, the FRT series was again higher than the original despite the new accounting method – roughly 1% of GDP higher on the revenue side and between 0.3% and 1% of GDP higher on the expenses side. The meaning of all this? If you are going to compare spending over the entire sweep of history in a comparable sense, the second series likely overstates what the feds took in and spent. That means the federal share of the economy has likely not been this low since prior to WWII.

So what’s the punchline? Not only will we need more federal spending to deal with the challenges ahead, we can well afford it….if we can only convince ourselves that we can afford more taxes.

The Canadian economy is five to six times larger today than in the 1950s and 1960s. Our parents’ generation had way less money and paid more taxes as a proportion to their incomes, but back then it wasn’t viewed as a hardship. Indeed, people understood they were pitching in to create something different, a whole new world that gave Canadians more opportunities than any previous generation.

Far from talking about how we are going to build the future, our generation is having trouble getting a grip on how we’re going to pay for maintaining what we’ve got. That angst doesn’t match up with reality: we have plenty of economic and fiscal room to create the world we want.

You can bet that kind of future-think won’t be part of the upcoming budget. It’ll be a hunker-down affair, more likely to duck the big issues than face the music. But figuring out what needs doing through public supports will be at the heart of budget-related discussions Canadiansn have in the years to come. And it will mean more, not less, government.

I keep saying to anyone who will listen that the size of the federal government (as a share of GDP, which is the correct measure) is smaller than what John Diefenbaker saw. References to a ‘bloated federal government’ or ‘runaway federal spending’ simply make no sense in the context of historical data.

but when you are a reformer from out west any government expenditure is a target given their eternal quest for smaller government. I wonder, potentially if we let them have their way, they could widdle government away to a such a meaningless small nothingness that maybe Mr. Harper would actually vanish! Now there is a positive thought!

I feel like I live in two different countries – one, my daily life, often reflected in the pieces I read here, and the other, created by the CBC, the Globe and our political and cultural elites. If I tune out the elites for more than just a few days I start to feel mysteriously better…

The financial markets could use some high quality Canadian government bonds. For infrastructure and other public investments the government should borrow and spend. Otherwise it should increase taxes on high income people, and increase transfer payments. Social policy reforms targeting housing affordability, and education look like obvious priorities, but I like spending on amateur sport, recreation, and culture as well, since these matter to people a lot.