Will Nova Scotia Implement a Carbon Tax?

There is some discussion in Nova Scotia about the possibility of the government introducing a carbon tax in the next budget. In this blog post I will introduce the context within which these discussions are taking place, and make reference to other blog posts in this forum that provide insights into how the province might best approach a carbon tax policy.

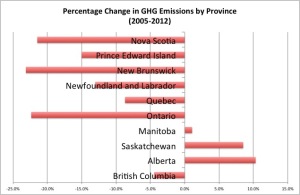

First, I believe Nova Scotia’s low-carbon transition does not receive the attention it deserves. The province is expected to generate 25% of its electricity from renewables in 2015, and has a target of 40% by 2020 (largely due to plans to import hydroelectricity from Newfoundland and Labrador). The province has become a leader in energy efficiency, led by Canada’s only non-profit “energy efficiency utilityâ€. It has also introduced hard caps on GHG emissions from the electricity sector. Much is made of Ontario’s dramatic reductions from the phase-out of coal-fired electricity, but Nova Scotia has made similar percentage reductions since 2005. Nova Scotia’s emissions reductions are driven by policies that can put the province on the path towards even lower emissions. (In contrast, New Brunswick’s large decrease seems to be mostly due to higher oil prices reducing electricity exports from an oil-fired power plant). (Of course I have to admit my bias here, since I was involved in NS energy policy during the introduction of many of these policies, as a consultant or environmental advocate).

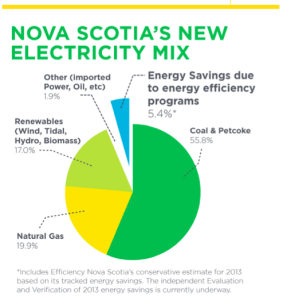

Nova Scotia’s example is important to the rest of Canada because it is a carbon-intensive province, with an electricity system based on coal, undergoing a significant energy transition. Many of the other progressive climate policies in Canada come from the less carbon-intensive provinces of Ontario, Québec, British Columbia, and Manitoba. If Nova Scotia were to implement a carbon tax it would fit nicely with its existing policy mix and contribute to a real transition away from fossil fuels towards a more efficient and clean energy system.

The idea of a carbon tax came from a report written by former Ontario cabinet minister, and new Nova Scotia resident, Laurel Broten. Her review of the tax system recommends a carbon tax that is “revenue-neutralâ€, with revenue earmarked for low-income support as well as corporate and personal income tax cuts.

Broten points towards the success of BC’s carbon tax. As demonstrated by Sustainable Prosperity, BC’s carbon tax has decreased emissions. The predictions that the tax would harm the BC economy have also not come true. BC’s GDP growth, relative to the rest of Canada, has been largely unaffected by the tax. The report also notes that recycling the revenues of the BC carbon tax towards tax cuts means that BC has some of the country’s lowest personal income and corporate taxes.

While one cannot claim that BC’s carbon tax has harmed the economy, nor is it possible to claim that these lower tax rates have helped it. As noted by Jim Stanford’s recent blog post, BC is not a bastion of economic prosperity (measured by GDP per capita) or social welfare (the province has below average per capita spending on health, education, and social assistance).

In Nova Scotia, the larger economic context is important to consider in the carbon tax discussions. A year ago a “Commission on Building Our New Economy†(also called the Ivany Commission after its chair) authored a report called “Now or Neverâ€. The report sounded an alarm bell on the province’s economic situation and called for a “province-building†project. The Commission report cast a wide net and could be used to justify anything. The commission supported the province’s continued transition towards a green economy. Some in the province have used the Commission’s message to call for government downsizing, austerity, and tax cuts. Hence, the interest in the “revenue neutral†carbon tax seems to be linked to some people’s interpretation of the Commission’s message.

Nova Scotians would do well to consider Marc Lee’s case against a revenue-neutral carbon tax. Lee notes that there is little evidence that personal income tax reductions benefit the economy by increasing the incentive to work. Even in neoclassical theory the economic impact of a tax cut is ambiguous because the increase in real personal income could make people engage in more leisure. Practically, there are a number of structural issues (like fixed work hours) that make it hard for people to increase their hours of work on the margin, as suggested by neoclassical theory.

From Iglika Ivanova’s recent post we can see that BC’s tax cuts have not resulted in better labour market performance or a quicker recovery from the recession. BC has not returned to pre-recession employment levels. In addition, total hours worked are now lower in BC than they were in 2008 (the year the BC carbon tax shift was introduced). Other provinces have seen a larger relative increase in hours worked since 2008. Clearly something other than income tax levels, and the trade-off between work and leisure is influencing the job market.

In Atlantic Canada there is the traditional issue of people “Going down the Road†to find work in other parts of Canada. But this is not because of a lack of incentives to work instead of engaging in leisure. It is because of a lack of job opportunities.

What about corporate taxes? These tax reductions seem to only be contributing to cash hoarding by corporations. They are not encouraging investment (See Erin Weir). An industrial innovation strategy reliant on tax incentives seems doomed to fail.

So here are some takeaway lessons as Nova Scotia considers implementing a carbon tax. First, such a tax will help decrease GHG emissions and hopefully complement other climate change and energy policies in the province. Second, if what is really needed is a “province building†project, it makes sense for Nova Scotia citizens to have a fuller discussion on how the carbon tax revenue could be used for this purpose. For instance, the tax revenues could be used in a targeted way to facilitate an industrial transformation towards a green economy, to increase community innovation and economic development initiatives, to really tackle energy poverty, and to enhance energy security by accelerating the move away from imported fossil fuels with more energy efficiency and renewable energy.

Stay tuned to see what happens in Nova Scotia.

The Broten report started by insisting on holding the line of program spending which in effect is a cut and though it said a pollution tax would be revenue neutral, proposed tax cuts for the top income bracket and cuts to business taxes. The premier is now on the bandwagon of the Atlantic Institute for Market Studies argument that our public service is too large. We are heading to an austerity budget. Not sure how any of this is in any way progressive!

Beware the Broten report. It is a straight up attempt to move towards a flat tax world. It notes – not as a compliment – that Nova Scotia has the most progressive income tax structure in Canada. It intends to change this. Proposals include tax cuts for the top three income tax brackets, an increase in small business tax from 3% to 8 % and an overall increase in consumption taxes, such as HST. It would put the “pollution tax” on all fuels for all sectors, including fisheries. There is more-see http://www.novascotia.ca/finance/en/home/taxation/default.aspx, but read carefully!

Agreed that a carbon tax will help reduce emissions, and is probably the most efficient way to do so. However, it does this by making the price of carbon-intensive energy more expensive (“internalizing” the external cost of GHG pollution), which means that everyone will pay more for it. That can’t be helped; in any system to price carbon, the objective is to make the price of fossil fuels reflect their true cost – no more treating the atmosphere like a free dump – and discourage use. But what CAN be helped is how this impacts lower-income households. Reducing income taxes, as BC has done, does little to help people who scrape by on very low incomes and thus pay little to no tax…but those people will still have to pay higher energy costs. It gets worse: lower-income households pay a higher share of their income on that energy than higher-income households, so a simple carbon tax is effectively a regressive measure (see http://pricecarbonnow.org/impact-carbon-pricing-households ).

It doesn’t have to be this way; we can have our cake and eat it too. The way to do that is to provide direct dividends to all residents (a la quarterly GST rebates) instead of reducing income taxes. This can be on an equal per capita basis, or progressively tied to income, but the result is the regressivity is more than eliminated (see http://www.synapse-energy.com/sites/default/files/REMI-carbon-tax-report-62141.pdf )

Let’s hope that, in the face of federal inaction, if Nova Scotia (or Ontario) put a price on carbon they do so in a way that does not disadvantage the poor. They can, in fact, reduce emissions with a price on carbon and use the opportunity to reduce income inequality at the same time.

Progressive tax and Nova Scotia? Try living here on $25k a year. The income and provincial taxes are killing me.