A Fine Balance: GDP Growth by Sector and the Impact of Austerity

The second-quarter GDP numbers confirm that Canada’s continuing “recovery,” such as it is, is still balancing very precariously on a knife-edge between expansion and contraction. The various sources of growth vary widely in their current momentum. The overall net balance is barely positive. And coming austerity in the public sector could very much push the balance into negative territory in coming quarters.

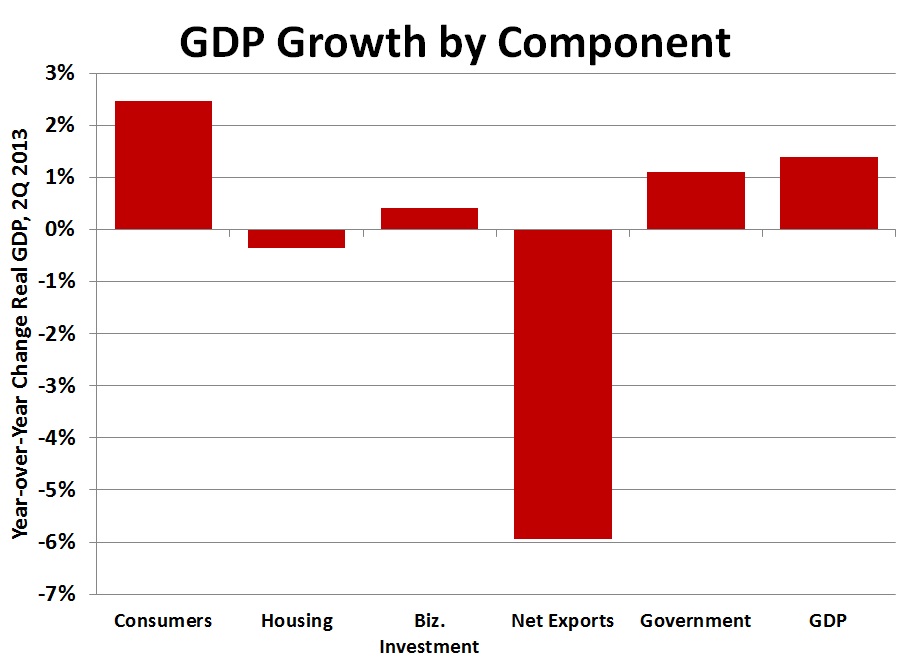

Here’s how the numbers add up. I examined the year-over-year change in each major component of GDP (the familiar C+I-G+X-M, with housing investment broken out as its own category), using real (chained 2007) data. The ultimate change in real GDP depends, obviously, on a weighted average of all the component changes. This is a simple way to think about where the impetus for growth is coming from (or not, as the case may be).

The accompanying figure summarizes the data. Consumers are still spending at a decent clip, despite (or more precisely thanks to) their accumulating debt. Residential housing investment has now peaked and is starting to decline moderately. (Recent data on housing starts and residential construction employment suggest further flatlining or gentle contraction in this volatile sector.) Business capital investment continues to be lacklustre, despite abundant corporate cash flows. In fact, this graph overestimates the strength of business investment because of well-known problems with the implicit GDP deflator for this category of spending (apparent prices of business capital are distorted downward by the secular fall in the price of computer-related assets, and this makes “real” investment spending look bigger than it is — at least in macroeconomic terms). Net exports are a wipe-out: the trade deficit continues to widen in the face of iffy global demand and our overvalued currency. This result is especially disappointing in light of recent improvements in U.S. demand conditions; it indicates the deep structural weakness in Canada’s participation in the global economy that the Harper government’s rush to sign more FTAs will only reinforce.

This leaves the government sector, considering both current “consumption” (spending on programs) and capital investment (infrastructure). The net year-over-year increase as of the second quarter was still positive, but barely so: up by 1% in real terms. This reflects growth in real current consumption (up 1.4% year over year), offset by a contraction in capital spending (down half a percentage point). The net trend in total government spending has recovered from the significant negative values recorded in 2011 (as temporary stimulus spending, mostly on capital “make-work” projects, was being unwound). But at barely 1% real government expenditure is still shrinking both as a share of GDP and in real per capita terms, and hence can be considered evidence of continuing austerity. In contrast, when the economy was recovering much more robustly in latter 2009 and 2010, total government expenditure was growing by as much as 6 percent year over year.

The weighted average of all sectors produces the uninspiring 1.4% year-over-year expansion in total GDP recorded in the second quarter. That’s not enough to offset productivity growth and population growth — which is why there has been no further recovery in the national employment rate (employment as a share of the working-age population) since the end of 2010 (almost 3 years of labour market stagnation). This isn’t so much a “recovery,” as it is treading water.

What’s the outlook going forward? In short: more of the same. There’s no sign of coming vigour in either net exports or business investment (what are supposed to be the major engines of growth in a globalized capitalist economy). Best case scenario for the housing sector is a continued soft landing: that is, an easy-going decline. Consumers are still willing to borrow and spend, for now: how that will hold up in the face of coming interest rate hikes (on both mortgage and non-mortgage debt) is an open question.

Fiscal policy will therefore continue to determine the net balance of economic forces. If governments decide to tighten spending further, then the overall balance would shift even closer to zero (or even cross to the minus side).

This simple analysis also highlights what is required to achieve a more optimistic outlook — one where expansion in spending is sufficient to generate a sustained increase in the employment rate, with resulting spin-off benefits for incomes, spending, and subsequent job-creation. New industrial and trade policies could help to address the weakness in net exports and business capital spending. Failing that, fiscal policy must do more of the economic lifting. The corporate sector continues to deleverage and accumulate liquid assets; there is no shortage of “money” in Canada’s economy. From a social perspective, therefore, there is no fiscal constraint on government’s ability to lead future growth through a major and sustained expansion in spending (especially capital spending — for example, on transportation, housing, and green energy).

After all, that’s how we solved the last decade-long stagnation. Today, five years after Lehman Brothers, it’s increasingly clear we need something similar (hopefully not motivated by war) to end this one.

You understand Wynne Godley and sectoral balances but how many of your peers in positions of influence do? In the zeal for policies in pursuit of ‘rate normalization’ our (hopefully) well intentioned policy makers could push this fragile economy into recession quite easily. While in the zeal for a balanced buget by the next election Jim Flaherty can see how ineffective his supply side endeavours will be in a world full of low effective demand, rising inequality and high personal indebtedness.

Okay a long post for those that dare! Don’t take this personally Jimbo.

The path to growth: where is it? Think about replacing Shadow banking in the main with high waged workers in the green.

– the dollar is inflated and suffers because of the dutch disease and commodity speculation

– manufacturing and forestry heartland of Ontario and Quebec gets beaten by the downturn and we lose over 600K jobs in manufacturing and over 200K in forestry since 2005 accelerating substantively in 2007.

– housing boom and construction jobs (still near all time highs), resource extraction in the private sector and a strong public sector kept the winds in our economic sail. Domestic demand is propped up by consumer debt which is now most likely at its peak and against the wall.

– however, it is a very delicate balance and the losses in manufacturing are not sustainable unless we get some longer term solutions, but the neo-conservative policies like corporate tax cuts, attacking unions, lowering standards works to alleviate these job losses.

– austerity starts setting in at three levels,- Rob Ford in TO starts his neo con cutting , the Drummond report in Ontario starts a slow walk into austerity and now Harper’s attack on the public sector and unions, all create a reduction in demand.

– this creates a strong negative push into the labour market and all the delicate balance between taxation and private public sectors sets about a self fulfilling goal of ratcheting down domestic demand.

– this creates new pressures on consumer debt, but because we are up against the debt wall, we start having pressure on the housing bubble in a downward direction as eligible mortgage holders start to fall (this does not of course include the external speculative pressures in housing which actually could play some role in supporting overvalued housing prices and indeed seems to be the case- but for how long as there are many areas across the glabe that this foreign speculation could go. So we live on the edge of slowly deflating the housing bubble and the credit debt wall or the bubble bursts. The point is, though, it will deflate without more consumers buying inflated housing.

– this creates two effects, first, consumption declines because of falling housing prices, even CMHC mortgages will decline. Secondly, this hits the construction sector, which as stated is the great, albeit short run equalizer for the declining manufacturing sector. More high paying jobs are trashed in construction

.

– So now everybody losing a job basically finds employment in the increasingly precariousness of work which accelerates. Backed up by some very poor stripped down social safety nets and we are all soon working in racing to the bottom precarious jobs.

– so my 500K minimum jobs lost do not include precarious work effects.

so in the end my jobs lost would include

– 100k or more from public service cuts across the country

– 250k in construction as the housing bubble slows

– a stagnant manufacturing sector as the high dollar above PPP continues to hamper our costs of doing business in a very sluggish investment environment

Call me a pessimist, but I do not see where the growth will come from.

The US economy? But will there very nascent and tepid recovery be enough to lift even the US out of its long great recession? Given eth actions of the Fed yesterday and it’s oiling of the money printing press and not mothballing like many thought- I would speculate that we are not in Kansas yet.

Oddly enough the solution space is right in front of us- Corporations sitting on mountains of cash – however in this post recession- financial centric singing the worker blues economy- nobody seems to understand that the way out is brick and mortar reconstruction of an innovative green economy. If we can spend billions trying to keep the finance sector happy- why can we not just get beyond that unsustainable circuitry of capitalism? Not sure how long printing money can withstand the political instability that it breeds! But given the vested interests- potentially we economists just simply fail to see the political wall we are up against- capital will not come willingly out of its insular financial economy until we make the social space too big to fail. I would have a look at the title of this year’s Socialist register “The Question of Strategy†as a means to solving the gridlock- and oddly enough with the antiunion- class warfare being ignited by right wing forces, it could actually be the rights strategy that brings out the shop floor into the streets response. Until labour gets over its internal turf wars, its lethargy and its corporatist nature- we will be stuck. Unifor is a not bad start in that direction, although the paltry 10% allocated to organizing is hardly a valid threat to take on the likes of seemingly unorganizible like walmart(despite my not liking the lack of a hammer or a sickle in the logo). Is it me or is it really that difficult to organize workers?

that should be the neo con policies do not work in bringing back the jobs