Canada’s incredible shrinking public sector

(Here’s a piece that will be in the next quarterly Economic Climate for Bargaining publication I produce, also posted on the CUPE website in pdf format.)

There’s a widely held myth now accepted by many people—that public spending in Canada has increased steeply and is growing at unaffordable and unsustainable rates.

In fact, the opposite is true. The latest figures show just before the economic crisis total government current spending in Canada was in fact cut to its lowest share of the economy in at least three decades.Â

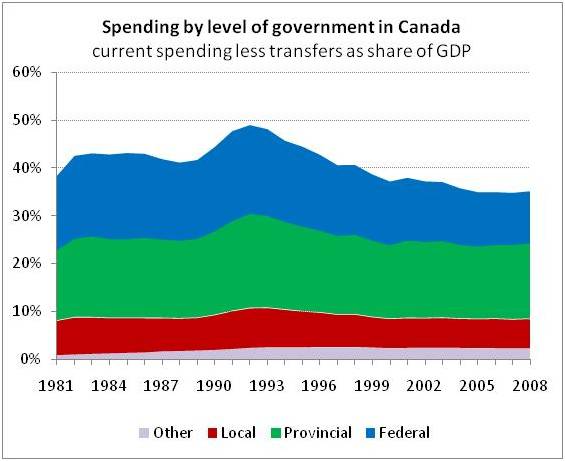

The same goes for total government taxes and revenues. By 2008 total government revenues were reduced to their lowest share of Canada’s economy since at least 1981—the furthest back these particular numbers are available. Here’s a chart that illustrates those figures nationally:

While figures for more recent years are not yet available, they are certain to show a spike in recession-related spending. But this spike will be temporary because so much of the stimulus spending was short-term. In the past few years, there’s also been a significant increase in capital infrastructure investment (not included in these figures on current spending) to reduce some of the public infrastructure deficit.Â

Increased support is required to make up for a lack of public infrastructure investment in previous years, but this doesn’t reflect on the sustainability of current public spending. A decline in debt interest costs has helped reduce overall current spending, but that’s only part of the story. Most other major components of government current spending are also at or close to 30 year lows as a share of the economy.

What this shows is the deficits we face weren’t caused by unsustainable rates of public spending. Instead they were caused by the financial and economic crisis over the short-term and declining revenues over the longer term. Squeezing public spending further to pay for the costs of the crisis is not only unfair; it will also inevitably lead to diminished public services.

Members of the public may not feel their tax load is going down. That’s because for most workers one of the few things shrinking more than the public sector is the value of their wages. Corporate profits and top incomes continue to escalate, but little trickles down. Â

Instead, business lobbyists are using the straitened circumstances of households and misinformation about public sector workers salaries to gain support for cuts to taxes and public spending.  This leads to increased costs for households as public services are cut and downward pressure on wages—an ongoing downward vicious cycle in the standard of living.

For much of the public, their tax load has increased. That’s because there’s been a big shift in our tax system from relying on progressive income and corporate taxes to a more regressive system with reduced taxes on business, high incomes, capital and savings together with increased consumption-based taxes on households.Â

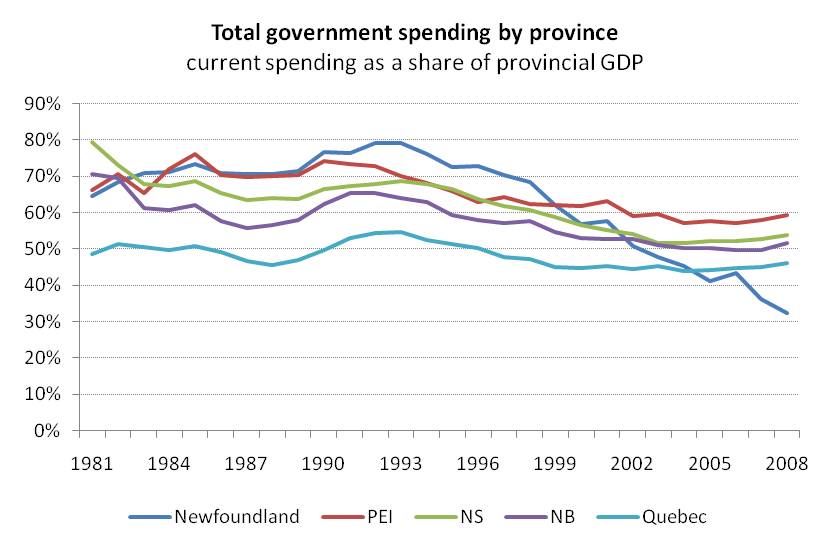

Much has been made about increased spending by some provinces. However, these rates of spending need to be looked at in context.  There has also been a big change in responsibility for public services shifting from the federal level to the provincial level. Â

Harper has increasingly transformed the federal government into an HQ for defence and security and a cheque cashing and clearing agency while relegating responsibility for the rest to the provinces and to individuals.  Federal spending may have increased in recent years, but much of that was defence spending and transfers to the provinces, counted as spending again at that level.

What is relevant is overall net spending. And in virtually every province it’s the same story: total government spending as a share of the provincial economy has recently fallen to a 30 year low.

Here are charts that illustrate total government current spending by province, one for eastern Canadian provinces and Quebec, the other for Ontario west.   Figures are also from Statistics Canada’s Provincial and Territorial Economic Accounts Data TablesÂ

Â

Â

Â

All part of the Conservative Rights agenda to turn over services to private interests,discipline the workforce and further the corporate agenda for control.

nice report Toby, further evidence that much of the discourse around the current increasing assault on the public sector, especially down south which after monitoring the snake movements, seems to be traveling north across the border.

It truly is a spectacle that we are witnessing, after 30 some years of the ever building forces of free markets fail again!!! to a point of financial calamity and make the whole equation to balance public and private needs a whole lot more difficult to balance, at least given the lens we are seemingly forced to look through for solutions. And this all off the backs of the citizenry through a massive bailout, and then unleash a tirade of misguided propaganda convincing the working middle class who benefit the most from a collective sharing of public resources, that indeed austerity is a much needed force to balance the imbalances.

Just amazing really to stand back and see it- (actually much better to dig and and fight it- which we are witnessing right across the world) And I do think much of the unrest whether it be in the middle east, Europe and now the USA is a result of that ratcheting down by the financial sectors upsetting the apple cart. However this has been slowing eroding all those precious social gains during that brief respite and class war and other wars of the post war era. Those decline starting in the late 70’s culminating in this massive crisis in 2008 just accelerated the whole mess.

So in many ways, potentially timing wise, it was something that works in favour of positive progressive change that we had the crisis in such a massively episodic fashion, as if it were allowed to follow the slowly eroding course we were on , it would have been a lot less barbed and less asymmetrically distributed globally as we currently are experiencing.

What we are witnessing are the free marketers in hurry up offense in a very loud and quite messy campaign to push the economic losses caused by the failure of the free markets onto the working middle class. Which I am hoping will soon make a much loader appearance in Canada. ( what about that Trish, ‘Working Middle class?’ hmm the term middle class is seemingly too septic and I am not sure about working class it may just bite too hard to those middle minded liberals)

Hey Toby, you are a mensch did I tell you that lately, probably not huh? great work!

In addition to all of the domestic effects of decreasing public spending and a ‘shrinking public sector’, I think it’s also worth mentioning the potential effects of these trends to Canada’s international standing.

In line with general spending cuts since the second Trudeau government, DFAIT’s budget has been shrinking as well. I wonder how much Canada’s declining international presence had a part to play in our failure to secure a seat on the UN Security Council in October of last year.

I think that our new-found role in international security may also have played a factor in us not winning the seat. Despite the prestige we received following our decision to not partake in the Iraq war (outside of Washington that is), our increasing security cooperation with the US seems to have changed perceptions of Canada as a simple US bandwagoner in the eyes of the international community. Unlike DFAIT, DND has been expanding at breakneck speed since the Chrétien government. Although I find it hard to determine whether the decline of DFAIT and the rise of DND, symptoms of the general decline in the Canadian public service, are the causes of Canada’s declining standing or merely symptoms of larger international trends, I definitely agree with the argument presented here that, not only is the public service not to blame for ‘Canada’s ills’, but there are instances where the opposite may in fact be the case.