Canada Once Again Adding Value to Its Exports

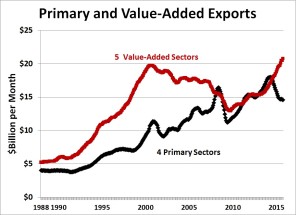

In the course of researching a forthcoming commentary on Canada’s trade policy for the good folks over at the IRPP, I stumbled upon a surprising and encouraging bit of data. I grouped Statistics Canada’s series on exports and imports by broad commodity grouping (CANSIM Table 228-8059) into three categories: 4 primary sectors (including agriculture, energy, mining, and forestry), 2 intermediate sectors (basic metal and industrial products), and 5 value-added sectors (machinery, electronics, auto, aerospace & other transport equipment, and consumer goods). Canada’s overall trade balance has deteriorated badly since 2014 (from an already weak position), thanks in large part to declining energy prices. But there are some bright spots in the picture.

In particular, the data indicate impressive growth over the last 2 years in all of the 5 value-added sectors (led by a 42% 2-year compound expansion in other transport equipment, mostly aerospace). This expansion has offset much of the decline in primary exports. By mid-2015, value-added exports surpassed primary exports as the largest component of Canada’s exports (see figure). By the end of the year, those 5 sectors were accounting for around half of all exports, compared to just over one-third in early 2014. (Back at the turn of the century, value-added exports were worth twice the primary exports, and accounted for two-thirds of all exports.)

Source: Author’s calculations from CANSIM data; 12-month moving averages.

This surge in value-added exports suggests a few conclusions for me:

- The lower dollar is contributing to renewed strength in these exchange-rate-sensitive sectors.

- Some of that strength reflects immediate denomination effects (eg. auto parts exports are usually specified in $US terms, so the falling loonie immediately boosts the value of a given flow in $C terms), but even this translates into improved profitability of those industries in Canada, and hence more opportunity for future investment and real growth.

- The relative erosion of those value-added industries since 2000 did indeed reflect “Dutch disease” effects (I prefer the term “resource-led deindustrialization”). A lower currency will not automatically reverse those painful changes, but it creates economic space which could be utilized by domestic producers (supported, we hope, by a more pro-active approach to sectoral development policy — as has been enunciated in the Alternative Federal Budget, by Unifor, and others).

The Globe and Mail ran a non-technical commentary from me on this issue on January 2 — concluding with a parting shot at the Harper government’s obsession with signing blockbuster trade deals, when it should have been concentrating on concrete efforts to strengthen these key value-added sectors. The column is available here, and posted below:

Canada’s value-added exports present a good-news story for 2016

By any definition, 2015 was a lousy year for Canada’s economy: complete with a technical recession, plunging oil prices, and big stock market losses. Lurking in the statistics, however, is an unreported but encouraging good news story. There is growing evidence that the national economy is starting to pivot away from past over-reliance on the extraction and export of raw natural resources (and energy in particular). Instead, Canada’s high-technology industrial base is starting to flex its muscles once again. And the first place this economic reorientation is becoming visible is in recent data on international trade.

We all know that energy and mining have been hammered by the global commodities collapse. But other exports are now starting to fill the gap. Statistics Canada defines five broad categories of “value-added†merchandise exports: industries that rely primarily on technology, productivity, and skilled labour, instead of just the availability of natural resources. These sectors include industrial machinery, electrical and electronic products, motor vehicles and parts, aircraft and other transportation equipment, and consumer goods. These technology-intensive products typically command premium prices on global markets (in contrast to depressed commodity prices).

Based on the most recent trade data (up to October), Canada’s exports in these five sectors are growing like gangbusters: up nearly 15 percent year-over-year, on top of impressive 12 percent growth recorded in 2014. In just two years, therefore, Canadian value-added exports surged by a compounded 28 percent. In contrast, exports of “primary†products (minimally processed resources, including agricultural, energy, mineral, and forestry products) declined 9 percent over the same time – dragged down by slumping commodity prices.

In January 2014, the five value-added categories accounted for just 35 percent of total Canadian merchandise exports. By late 2015, they accounted for half. In fact, once the year-end numbers are in, it seems certain that Canadian value-added exports will set a new annual record (about $240 billion), finally surpassing the previous peak set back in 2000.

Auto is still the king of Canada’s value-added exports. Exports of vehicles and parts this year will total $85 billion – almost twice the depressed levels recorded in 2009. Even more spectacular growth has been recorded by other transportation equipment producers. These exports (led by aircraft) surged 42 percent in the last two years. In fact, aerospace is one of the only high-tech sectors in which Canada generates a trade surplus: selling more to the rest of the world, than we buy back.

The value-added export boom is also evident in industrial machinery (up 22 percent in two years), electrical and electronic products (22 percent), and consumer goods (33 percent). Thanks to the strong turnaround in these key sectors, we are proving once again that Canada can be more than just a supplier of raw materials to the rest of the world. Given the right economic conditions and policies, we can produce (and export) technology-intensive, value-added products with the best of them.

Two key factors explain this impressive expansion in value-added exports. The strong U.S. economy (still the destination for most of our manufactures) is opening great opportunities for Canadian products. And the loonie’s return to earth (after a decade at unsustainable heights) has boosted exporters’ margins and restored the cost competitiveness of Canadian products. In fact, in auto and most other value-added industries, Canada is once again very attractive on cost grounds relative to other industrial countries (including the U.S. itself). This should spur more investment in Canadian facilities, and hence more production and exports, in the years ahead.

The export surge from these strategic sectors is not yet translating into robust hiring or GDP growth across manufacturing as a whole. But it’s the leading edge of a process that should eventually translate into more investment, output, and jobs. Canadian factories are busier, the quality and appeal of Canadian output is on display, and the foundation is being laid for longer-term expansion.

There is a surprising policy lesson from this good news story. For years the federal government was obsessed with negotiating new blockbuster trade deals – like CETA and the Trans-Pacific Partnership. Neither is in place, and there’s considerable doubt either ever will be. In the meantime, surprisingly, it turns out that our high-value exports could be boosted more effectively through other means.

Perhaps Ottawa should worry less about trade deals (which in fact may hurt value-added industries more than helping them), and focus on delivering concrete, immediate support to strategic export-oriented industries. By cementing new investments and product mandates, and supporting domestic high-tech exporters (from Blackberry to Bombardier), government would make a much bigger difference to Canada’s revitalized value-added exports, than barking up more free trade trees.

Good luck down under and thanks for all your hard work. Etobicoke Casting Local1459