Jason Kenney, TFWs, and Canada’s Services Trade

When he announced the sudden moratorium on new Temporary Foreign Workers (TFW) in the restaurant industry, Employment and Social Development Minister Jason Kenney tried to reconcile this dramatic about-face with his government’s long-standing support for the whole idea of migrant guest-workers. So while strongly criticizing a few particular restaurants for their high-profile “abuses” of the program (even though it was usually hard to see what rules were actually broken), he at the same time mounted an energetic defense of the whole TFW program. (Here’s my Globe and Mail column on the political reasons for Kenney’s reversal.)

Simultaneously supporting and opposing a policy is a neat trick, but Mr. Kenney gave it his best, with interesting results. For example, incredible as it may seem, he claimed in Vancouver that his government was “distressed that wage rates have barely kept pace with inflation since the global downturn, which is not indicative of a tight labour market.” Apart from constituting a 180-degree U-turn from his oft-stated view that Canada is suffering from a pressing skills shortage, this newfound concern for the laggard pace of wage growth in Canada also contradicts the whole thrust of federal Conservative labour policy (which has focused on hamstringing unions, weakening labour standards, forcibly imposing wage restraint on federal and Crown Corporation employees, and compelling EI recipients to accept lower-paid job opportunities … where, that is, they even exist). If the government were genuine in its concern that wage growth is too weak (as it should be: stagnant labour incomes are clearly hurting economic recovery and exacerbating the problem of excess household debt burdens), then changing that overall anti-labour orientation would be the place to start. But that ain’t gonna happen: Mr. Kenney’s crocodile tears over stagnant wages were opportunistic, to put it mildly, and issue-specific (limited to the TFW debate alone).

Another curious example of the Minister’s spin-doctoring was a series of tweets he issued on April 25 defending the TFW program — even as he was slamming the door shut to its biggest single user (the hospitality sector). Minister Kenney is energetic and proficient in utilizing social media; his tweets are accessible on his personal Twitter account (@kenneyjason), and several were reported in the media (eg. by CBC here).

One tweet begged Canadians to “have some nuance” in the debate over TFWs. But the one that really caught my eye was this claim (the 7th of his 8 tweets on the subject that day):

That is a dramatic statement indeed. It is well-known that Canada’s manufacturing industry, for example, intensively utilizes imported parts and components in virtually everything it does. Closing the borders to all imports (something that no-one I am aware of has ever suggested) would shut down the auto industry within hours (as we learned the hard way following the 9-11 terrorist attacks and resulting U.S. border disruptions), and other export-oriented manufacturers would not be far behind. Other merchandise exporters (in agriculture and resources) also use imported inputs in virtually everything they do. Closing our borders to imports would be an enormous and disruptive event for our goods exports, and indeed for our entire economy.

Could ending the TFW program possibly have the same impact on Canada’s important services trade, which totalled about $200 billion (on a two-way basis) in 2013? Let’s begin by examining the composition, pattern, and balance of our services trade. Indeed, one unintended benefit of Mr. Kenney’s tweet might be to focus a bit more public attention on services trade, because it is undeniably important to our economy — and our recent miserable performance in this area does not receive as much attention as it should.

Canada’s exports of services have followed the same general trend as our non-energy merchandise exports since the turn of the century: namely, steadily down. The first figure illustrates Canada’s exports of services as a proportion of national GDP. After strong growth in services exports in the 1990s, this ratio peaked at 5.4% of GDP in 2000. It has since declined steadily, including in 2013 when this ratio fell to 4.6% — its lowest in almost two decades. This is a similar pattern to non-energy merchandise exports, although not as dramatic. As a share of GDP, our services exports have declined by 15 percent since 2000 (in contrast, our exports of non-energy merchandise, which also peaked in 2000, have since declined by 45% measured as a share of GDP). Presumably, similar factors (including an overvalued loonie, weak demand in our trading partners, and the rise of lower-cost global competitors) explain this erosion of our services exports.

Immediately, this data casts doubt on the pat claim of many free-traders that we don’t need to worry about the decline of Canadian manufacturing, because the rise of “post-industrial” exports will automatically offset that contraction. In fact, the decline of services exports is accentuating, not offsetting, the continuing decline of non-energy merchandise exports.

Canada’s exports of services have declined as a share of GDP, but our imports of services have grown as a share of GDP (reaching 6 percent of GDP in 2009, and staying steady at that level as the economy clawed its way back from the recession). The result has been a substantial increase in our services trade deficit, which has quadrupled since 2005. By 2013 the services trade deficit was almost $25 billion, the worst ever. In fact, since 2010 the deficit in services trade has exceeded Canada’s traditional payments deficit in investment income (which has historically been a major drain on our balance of payments, reflecting the unusual importance of incoming foreign direct investment here). The services sector is thus the largest single contributor (larger than the goods or income deficits) to Canada’s now-chronic balance of payments deficit — which continues to rack up international debt at the pace of $60 billion per year. (If we disaggregate merchandise trade between energy and non-energy merchandise, then our enormous deficit in non-energy trade would be the largest contributor to the CAB deficit: over $70 billion in the red in 2013.) The services trade imbalance accounts for about 40 percent of that substantial and costly CAB deficit. The services trade deficit is now equivalent to about 1.5% of Canada’s GDP.

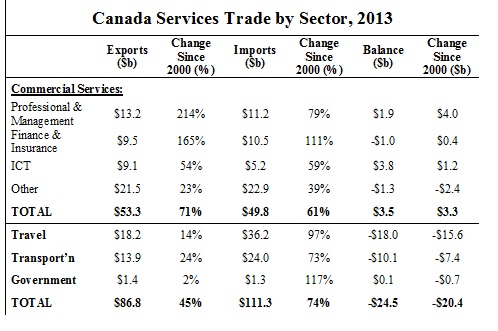

“Services” is a very diverse and general category, and not surprisingly our trade performance varies a lot depending on the precise activity considered. The first table disaggregates our services trade into its major components, ranked in terms of export importance: commercial, travel, transportation, and government services. (International trade in government and public services is very small, though it is interesting to note that Canada’s imports of these services have grown 60 times faster than our exports since 2000 — likely reflecting the expansion of outsourcing and offshoring in some of these services in Canada.) The three largest sub-sectors of commercial services trade are also broken out in the table: professional/scientific/technical, finance and insurance, and information and communications technology. Since 2000 was a turning point in all our trade (including merchandise), the table reports trade flows in 2013, and then summarizes how trade in each category has changed since 2000.

Overall, Canada’s services imports grew by 75% between 2000 and 2013, while our exports grew only 45%. No wonder, then, that the deficit in services trade grew six-fold in that time: exploding from $4 billion in 2000 to almost $25 billion last year. The worst damage was experienced in the travel and transportation sectors, where import growth was very fast (in travel, an “import” means money spent by Canadians travelling abroad) and export growth was very weak (with nominal exports not even keeping up with inflation in either case). The trade balance thus deteriorated dramatically in both travel and transportation. These sectors are especially sensitive to the exchange rate; the overvalued Canadian dollar since 2000 has made Canada an extremely expensive destination for travellers (both tourists and business travellers), and our performance in these sectors has melted down just as dramatically as our trade performance in manufactured goods. Declining business and layoffs in travel and transportation-related industries have contributed to Canada’s economic problems in recent years — a problem that has been felt especially severely in border communities.

In contrast, it is interesting to note that Canada’s performance in commercial services trade has been more positive. Export growth actually slightly outpaced import growth since 2000, contributing to the emergence of a small trade surplus in commercial services (equal to $3.5 billion in 2013, offsetting only a small portion of the larger deficits incurred in travel and transportation). Professional service and finance sector exports have been the most expansive during this time, reflecting the world-class status of some Canadian-based companies in these sectors.

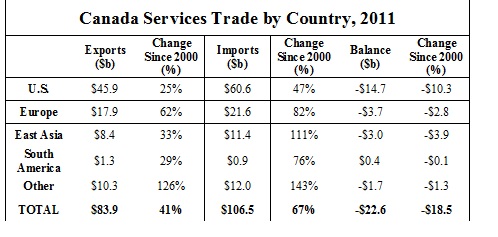

The next table reveals that the deterioration in Canada’s overall services trade performance has been experienced across most of our major trading partners. (The latest data for this breakdown by country is available only from 2011.) Just over half of the total decline in services trade balances since 2000 has been experienced bilaterally with the U.S. (which accounts for just over half of all our bilateral services trade, so that ratio is proportionate). Bilateral services trade balances also deteriorated markedly with Europe and Asia.

In light of this portrait of Canada’s challenges in international services trade (reflected most painfully in miserable outcomes in the travel and transportation accounts), let’s go back to consider Mr. Kenney’s argument that the use of TFWs is a crucial input to our services exporters — and hence eliminating the program would wreak havoc with services trade. The best source of data on use of TFWs by sector is from Employment and Social Development Canada, which reports the total number of TFWs on Labour Market Opinions (LMOs) by year up to 2012. Remember, this only covers about two-thirds of all TFWs in the country (since some TFWs enter the country under other non-LMO streams, such as the NAFTA professional stream), but it is the best source of sector-by-sector data available. We compare it to Statistics Canada’s SEPH data on employment by industry; both sources use the same NAICS categories (at the 2-digit level) and hence are directly comparable.

On average, TFWs on LMOs are more important in goods-producing industries than service-producing industries. They accounted for almost 3% of all jobs in goods industries, but only 1.35% in services sectors. (While these ratios may seem small, don’t forget that the rapid expansion of the TFW program under the Conservatives has meant that migrant workers accounted for a surprisingly large share of all net new jobs created in the economy; employers tapped migrants for one in five net new paid positions created in the whole economy from 2007 through 2012).

Moreover, within services industries, TFWs are clearly concentrated in non-tradeable services sectors. 60% of all service-sector LMOs were issued in the three biggest sub-sectors, each of which is overwhelmingly domestic in its outlook: hospitality (with 45,000 LMOs), “Other Services” (21,000 LMOs, most of whom work in personal care), and wholesale and retail trade (11,000 LMOs). The proportional reliance on LMOs is highest, not surprisingly, in the hospitality and other services categories, where LMOs represented almost 4% of all employment — and where the expansion of the program has provided employers with attractive low-wage recruitment opportunities.

In contrast, a total of 23,000 LMOs were in effect in 2013 in the four major tradeable service industries listed on the table above: transportation, information, finance, and professional services. That represents 0.9% of employment in those four sectors. A more detailed disaggregation of employment within those tradeable services industries (were the data to allow for it) would likely confirm, I suggest, that the use of TFWs in the more specialized and innovative services jobs (those which are most oriented around exports to foreign purchasers) would likely be significantly lower. Of course, there are some TFWs who have entered Canada to fill higher-skill jobs, including some in finance, professional services, and other tradeable services. So we cannot say that TFWs play no role in services exports; they clearly do. But we can certainly say that TFWs are used less intensively in tradeable services than non-tradeable services, and even less intensively again than in goods industries. That makes it all the more curious for Mr. Kenney to highlight this part of the economy with his dramatic argument.

I suppose it could be argued that the use of TFWs in hospitality (the biggest single TFW user) is also a “tradeable” occupation, since a portion of demand for restaurants and other hospitality services comes from visitors to Canada. It is hard to believe, however, that being required to pay a little bit more for a Big Mac in the wake of Mr. Kenney’s moratorium (assuming, in fact, that McDonald’s franchises respond that way to the moratorium) could possibly damage tourism to Canada any more than our punitively high currency has already done.

Finally, let’s compare the very small role of TFWs in tradeable services production to the importance of imported inputs in Canada’s production and exports of merchandise. Imported content is equivalent to 20-25 percent of the total value of all Canadian exports (the higher figure comes from Statistics Canada’s own input-output estimates, the lower from the new OECD trade-in-value-added database). That ratio is higher in goods industries than services industries; it is 40% in manufacturing, and averages about 30% across all goods-exporting sectors. Cutting off imports would therefore deprive goods exporters of some 30% of all their inputs. Moreover, given the specialized and non-substitutable nature of many of those inputs (including specialized parts and equipment that may be produced by only one firm in the world), most of these imported inputs could not be readily replaced with alternative domestic sources of supply. In most cases, therefore, all production would have to cease until domestic substitutes could be developed (with enormous costs and delays).

Let’s conduct a similar analysis of the role of TFW labour in tradeable services. TFWs account for 0.9% of employment in key tradeable services industries. Their share of total inputs for those services exports is much lower: partly because their average incomes are low compared to other employees, partly because capital and other primary factors are also used in production, and partly because those sectors use produced inputs of goods and services purchased from other sectors (including imports) in their own production. Let’s generously say the TFW share of total produced value is half the TFW share of total employment. (We’d require input-output data disaggregated between regular workers and TFWs to calculate it more definitively; the true ratio is almost certainly smaller than this.) On that assumption, eliminating the work of all TFWs overnight would eliminate inputs equivalent to 0.45% of the total production in these four key tradeable services sectors. That’s less than one-sixtieth the impact of shutting down all imports, on Canada’s merchandise exports. Moreover, the labour of most TFWs can be replaced with labour from other sources, namely unemployed Canadians (whereas specialized imports of parts and equipment can rarely be replaced, at least not in the short term, by Canadian-made alternatives). So the logistical disruption to the production of tradeable services resulting from the elimination of the TFW program should not remotely be compared to the impact of closing off all imports on Canada’s merchandise exporting industries.

Consider further that no-one is proposing eliminating the actual work of TFWs overnight, even if the program itself (or, more specifically, its low-skill stream) were cancelled or dramatically curtailed. Even Mr. Kenney’s moratorium simply stops the growth of TFWs in hospitality and causes its eventual phase-out (presumably as existing LMOs expire, on assumption the moratorium stays in place). Opponents of the TFW program have argued for its replacement with systems of permanent immigration, and adequate transition measures to allow those who are in the country to continue working here under alternative provisions. (See for example the fine work of the Alberta Federation of Labour on this point.) In that regard, with due notice to both employers of TFWs and the migrant workers themselves, the TFW program (and in particular its most troublesome aspect, the low-skill stream) could be cancelled with no impact on Canada’s services exports. In fact, the impact on goods-producing industries and non-tradeable services would be greater (but still negligible, given appropriate notice and transition measures) than the impact on tradeable services.

In light of this evidence, Mr. Kenney’s claim that the TFW program is essential to Canada’s international trade in services should be seen as far-fetched and desperate. And the extravagant hyperbole of this argument makes a mockery of his own appeal, in his earlier tweet that same day, for more “nuance in the discussion” of the TFW issue.

If we are really concerned with boosting Canada’s exports of tradeable services, there are plenty of potential policy levers that should be pursued: like reducing the exchange rate; implementing active sector-development strategies in tradeable services (like ICT); using public procurement as a lever to support Canadian suppliers of software, technology, and other specialized services; and more. In our previous work highlighting the need for active policy efforts to diversify Canada’s resource-dependent economy, progressive economists have always emphasized the potential of high-value services industries (not just manufacturing) in creating good jobs and expanding our exports. (That’s why “industrial policy” is no longer an apt title for this set of strategic sector-boosting policies; I prefer the term “sector development strategies”.) In contrast, expanding the use of vulnerable migrant labour is hardly a credible strategy for building world-class tradeable services industries — which always depend on specialized technologies, skills, and innovation, not cheap desperate labour.

Yeah, Jason Kenney’s really concerned about stagnant wages. Next thing you know, we’ll see him marching at an Occupy rally. Well, his only job ever other than “Conservative politician” has been “lobbyist”, so maybe not.

You know, Jason Kenney is becoming a liability to the Conservatives and wouldn’t be surprised if he was shuffled out this portfolio. This TFWP mess makes it clear how incompetent this government really is. This program needs a full review by a 3rd party to get a sense not band aid solutions. I am certain this is the tip of the iceberg.

Thank you for giving this comment the critical attention it merits. That a successful politician would describe temporary workers as the extent of Canada’s services trade policy suggests a serious problem.