Distributional impact of Tory Income Splitting

I recently posted on the CCPA’s “Making it Count†blog covering election 2011 issues. In that post, I calculated the distributional impacts of the “Family Tax Cut†proposed by the Conservatives that would allow couples with children under 18yrs old to split up to $50,000 of their income. The “Making it Count†post is meant for popular consumption, but I figured readers might be interested in the full shebang so below is a more complete breakdown of who would benefit from the “Family Tax Cut†and by how much.

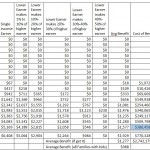

You’ll note that my estimates put the total cost at $2.7 billlion slightly higher than the Conservatives at $2.5 billion but the most important piece is how strongly the distribution of benefits skews to the wealthiest families.

(Click on thumbnail to see the full table)

Wow.

Nice work, David. What dataset did you use for this?

Largely the census data for the number of families. As for distribution of household earnings the Library of Parliament study on income distribution was useful. From there I constructed a simplified tax model to calculate before and after savings.

What is also very interesting is the source of this bizarre policy to come into effect if and when the budget is balanced. Yesterday I heard a spokesperson from that most religious, right, American of institutions, the Council for Marriage and Families, state that he has been advocating this for the 5 years since it has been welcomed into Canada by our most religious, right government. This is very concerning, especially as, if given a majority, this particular group will be given ever more influence on the way our country is governed.

Joan — See my comment in the Apr. 2 2010 Ottawa Citizen on the genealogy of income splitting in Canada. The Institute on Marriage and the Family Canada is just the tip of the iceberg. They plus Harper plus Mintz have created the claim of a ‘movement’ in support of this issue; in reality, this is just an old Reformer dream. (Of Harper’s?)

… and even if the shoe were on the other foot and my husband were the sole earner, I would not be staying at home, as nobody gave me any kind of financial guarantee for my marriage. Something can happen to him and we are both S-O-L, or he can decide to trade me in for a newer model, while I stayed home most of the time and thus, no job skills … I grew up in a household like that. My father earned great money and my mom stayed home; they divorced when I was eight, and she spent several years in poverty until she was able to finally secure a job in the civil service. A policy like this encouraged and aids and abets child poverty in the future, and is certainly not acceptable to me.