Can Capitalists Afford a Trumped Recovery? Guest post by Jonathan Nitzan & Shimshon Bichler

This provocative guest post submitted by Jonathan Nitzan and Shimshon Bichler, was published earlier this year on their bnarchives website. Nitzan, professor of political economy at York University, and Bichler, who teaches political economy in Israel, are authors of Capital as Power, a Study of Order and Creorder and numerous related articles.

To quote from the statement of purpose of the RECASP journal, “The framework of ‘capital as power’ offers a radical alternative to both liberal and Marxist political economies. In this framework, capital is viewed not as a productive economic entity, but as the central power institution of capitalist society at large, while capitalism as a whole is seen not as mode of production and consumption, but as a mode of power.” We welcome your comments!

Can Capitalists Afford a Trumped Recovery?

Shimshon Bichler and Jonathan Nitzan

Jerusalem and Montreal, January 2017

The presidential election of Donald Trump has rekindled hopes for a U.S. recovery. The new president promises to ‘make America great again’, partly by creating many millions of new jobs for U.S. workers, and judging by the rising stock market, capitalists seem to love his narrative. But if Trump actually delivers on his promise, their attitude is likely to change radically.

- What if Unemployment Falls and Employment Growth Accelerates?

First, the capitalist share of domestic income will probably drop precipitously. Figure 1 – an up-to-date version of a chart first published in Nitzan and Bichler (2014a, 2014b) [link] [link] – shows why. The top part of the chart plots the sum of pretax profit and net interest as a share of domestic income on the left scale, along with the unemployment rate three years earlier on the right. The bottom part of the chart shows the annual rates of change of these two series (with all data smoothed as five-year trailing averages).

The historical facts here are rather unambiguous: since the 1940s, lower rates of unemployment have been followed, three years later, by a lower capitalist income share. And if this relationship continues to hold, the implications for capitalists are doubly negative. Since unemployment has already been trending downward for the past few years, the capitalist income share is likely to lose further ground in the three years ahead quite independently of Trump’s policies. And if these policies end up delivering even lower rates of unemployment, the capitalist income share is likely to shrink further.

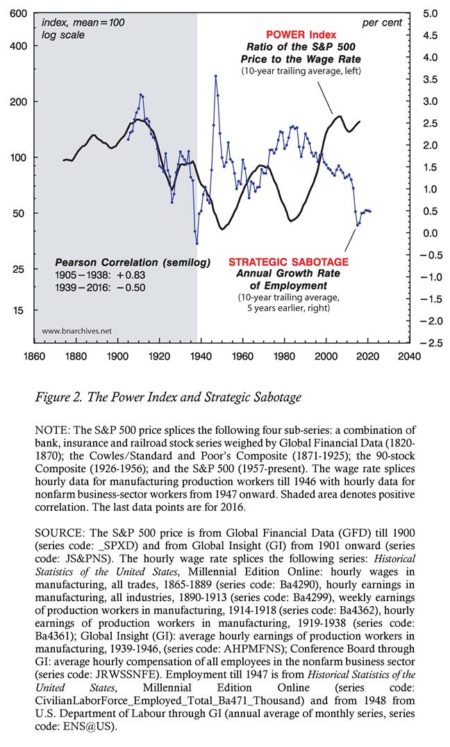

Second, a significant rise in employment will probably kill the stock market. Figure 2 – taken from our paper ‘A CasP Model of the Stock Market’ (Bichler and Nitzan 2016: 146) [link] – compares two series. On the left, it plots the ratio of stock prices to the wage rate, an index for the power of capitalists relative to workers. On the right, it displays the rate of growth of employment five years earlier, an inverted proxy for the strategic sabotage inflicted on workers (the two series are smoothed as ten-year trailing averages).

And here too the historical regularity seems clear: since the 1940s, rising employment growth has been followed, five years later, by a falling stock market (since the wage rate is usually a monotonically rising series, most of the movement here comes from changes in stock prices). With this pattern in mind, investor enthusiasm for employment growth policies seems somewhat misplaced: if the Trump administration succeeds in reversing the 30-year downtrend in employment growth, the likely result will be not a secular bull run, but a major bear market.

- The Current Crossroad

To put these constraints in a longer historical context, consider the following excerpts from our article ‘A CasP Model of the Stock Market’ [link]:

“Over the past thirty years, U.S.-based capitalists (and others investing in U.S. equities) have managed to increase their capitalized power relative to the underlying population from record lows to record highs [Figure 2 above]. In our view, this increase has been driven by two related processes: (1) a redistribution of income from non-capitalists to capitalists, along with a growing conviction that the resulting inequality could be maintained and even augmented in the future; and (2) mounting strategic sabotage in the form of lower employment growth. [. . . The] first process meant a higher hype coefficient [i.e., overly optimistic long-term profit expectations] The second process has had a double impact: on the one hand, it assisted the first process by restricting wages and boosting profits, while, on the other, it enabled looser monetary policy and lower interest rates, thus helping to reduce the normal rate of return [and raising the discounted value of expected future profit].

These two processes were in turn underwritten by a major creordering of the underlying mode of power. Following the MBM [major bear market] of 1968?1981, capital has been progressively transnationalized, leading to the gradual disempowerment of the underlying domestic populations, the lowering of corporate and personal tax rates for high-net-worth individuals, the hijacking of macroeconomic policy for capitalized ends and the cajoling-forcing of pension funds and public assets into the stock market, among others consequences. But no spring can be pulled indefinitely. Conflict-driven redistribution and lower interest rates have pushed capitalized power toward its historical asymptote, and this approach means that the United States – and maybe the world as a whole – is now facing a historical crossroad. (Bichler and Nitzan 2016: 150-151)”

Given this assessment, we outlined two possible trajectories for the U.S. looking forward:

“The less likely of the two is some version of Jack London’s The Iron Heel (1907), in which the U.S. ruling class breaks through its historical asymptote by imposing a mode of power much harsher than the one prevailing over the past two centuries. To sustain this new mode of power, the rulers would have to further redistribute income in their favour, domestically and/or globally, leading to historically unprecedented levels of inequality. Moreover and crucially, they would have to cast this greater inequality as the ‘new normal’ as well as persuade investors that this greater inequality is here to stay (so as to prevent hype from collapsing). And while doing all of that, they would also need to keep interest rates and profit volatility low in order to prevent the discount rate from rising significantly – a tall order in a world marked by greater sabotage, intensified violence and therefore greater instability. The other, and in our view more likely, possibility is that history will repeat itself, and that, sooner or later, the United States will experience another MBM [major bear market]. (Bichler and Nitzan 2016: 151)”

- A Trumped Recovery?

How do Trump’s hyped rhetoric and proposed policies fit into this framework? On the face of it, his authoritarianism, apparent disdain to the rule of law and promiscuous endorsement of violence make him a possible harbinger of the much harsher regime needed to secure and possibly extend current levels of capitalized power. This harsher regime, though, would have to cater to capitalist interests, and so far, Trump’s proposed policies point in the opposite direction.

Modern capitalism is guided by differential capitalization – particularly differential stock prices – and differential stock prices are driven not by rapid economic growth, but by the ability of owners to increase their capitalized power relative to the underlying population. As noted, since the 1980s, the differential capitalized power of stock owners increased due to a combination of a rising capitalist income share and falling interest rates, and taken at face value, Trump’s policies threaten both.

As we have shown in Figure 1, Trump’s focus on job growth stands to undermine the capitalist share of income. But job growth is likely to hurt capitalists in another important way – namely, by causing interest rates to soar and in so doing further undermining equity prices.

The history of this latter process is illustrated in Figure 3 (updated from Bichler and Nitzan 2016). The chart shows two series: the annual rate of growth of employment (lagged five years) plotted against the left scale and the yield on ten-year government bonds on the right. We can see that, until the middle of the twentieth century, there was little or no connection between the two series (Pearson coefficient of –0.12). But from the early 1960s onward, with the entrenchment of countercyclical Keynesianism, employment growth has become a nearly perfect five-year leading predictor for interest rates (with a Pearson correlation of +0.89). During the 1960s and 1970s, the welfare-warfare state lessened the strategic sabotage on the underlying population and accelerated employment growth, but this process triggered higher interest rates that grounded the stock market. The 1980s rise of neoliberalism, though, flipped the cycle. Employment growth decelerated, interest rates dropped, and the capitalized power of owners, fuelled by growing strategic sabotage and rising liquidity, soared.

In our ‘CasP Model of the Stock Market’ (2016) [link], we developed the concept of a ‘CasP policy cycle’, the idea that government policy, insofar as it caters to the imperative of capitalized power, favours low employment growth in order to enable low rates of interest and sustain the capitalist share of income. If Trump proceeds with and succeeds in reversing this CasP policy cycle, his authoritarianism may end up undermining rather than boosting capitalized power. In this sense, his regime could well mark the beginning of the next major bear market.

References

Bichler, Shimshon, and Jonathan Nitzan. 2016. A CasP Model of the Stock Market. Real-World Economic Review (77, December): 119-154.

London, Jack. 1907. [1957]. The Iron Heel. New York: Hill and Wang.

Nitzan, Jonathan, and Shimshon Bichler. 2014a. Can Capitalists Afford Recovery? Three Views on Economic Policy in Times of Crisis. Review of Capital as Power 1 (1): 110-155.

Nitzan, Jonathan, and Shimshon Bichler. 2014b. Profit from Crisis: Why Capitalists Do Not Want Recovery, and What That Means for America. Frontline, May 2, pp. 129-131.

A major bear market with a greatbout of deflation is unlikely. Interest rates in US will notnot outpace gains inflation.Negatives real rates will be in play most likly. Trump will focus on tarrifs and other protectionist measures that will limit US dollar bulls. The federal reserve will most likly not raise interest rates to fight off higher wages for low income workers if Trump has anything to say about it.

Trump will most likly seek to massivly devalue the US dollar wether by replacing Yellen with a dove and other members of the FOMC with doves. Anyone who beleives in this enviroment rising prices or inflation will lead to higher real rates above inflation are foolish. Public debt has exploded along private debt making rising rates an unantenable position for goverments in the west especially the US , and Canada. Can anyone imagine the Federal Reserve rasing rates to 20% as in June 1981 on current gross nominal debts. If you can and really truly beleive real rates will rise faster then inflation then deflation will ensue. We will have a traditional bear market then with rates outpacig growth in prices.

Trump knows were in one big fat ugly bubble due to low interest rates around the globe. When he says Germany(Eruo), China(Yuan), and Japan (Yen) are all engaged in currency debasement, I would also wager Canada (Cad), and Mexico (Peso) is on his list of offenders too. He inversely is saying the US dollar is too strong relative to other coutries, and those countires must allow their currencies to apprieacte agaisnt the US dollar. I just dont see a rosy scenario with a baer market of falling prices caused by higher interet rates due to rising incomes, wages, salaries in the US without causing massive deflation on a scale greater then 2007-8. My two cents Inflation has been alive and thrived post 2009 for any worker especially low income who has worked loner and longer and longer hours for the same ammounts of sevices or goods they had years before.

Too add by preventing prices from falling under Obama the FED helped elect Trum. Workers that traditionally vote democrat, and had voted for Obma twice voted Trump in by a slim enough margin. Prices outpaced wage growth handily, the entire time Obama was elected: inequality only grew worse with inflation as income inflated at the top with the bottom being killed by higher prices. The minimum wage at 12 dollars 40 hours a week for year isnt much. Now set the minimum wage to 45$ an hour and inequality will lessen but prices will rise faster and the problems society s much worse when you wipe out savers for borrowers. Which is already happening in my opinion. Saving is so useless compared to when my grandmother had 18.8 interest rate on her saving account post world ward two