Banking on Privatization?

Finance Minister Bill Morneau tables his Fall Economic Statement on 1 November. We’ll likely find out then whether he has some has real treats, or if they’re planning more privatization tricks for provincial and municipal governments, as his business-dominated Advisory Council on Economic Growth proposed in the form of a public-private infrastructure bank (and through their new term for privatization, creating a “flywheel of reinvestment”).

Today the Hill Times published a column I wrote on this, which I’ve also copied below.

There’s been some top-notch reporting by Bill Curry on this issue, and excellent columns by Tom Walkom, Jennifer Wells and Andrew Jackson.

The institutional investors promoting this (such as Caisse de dépôt et placements CEO Michael Sabia and Blackrock Inc. Managing Director Mark Wiseman) aren’t now publicly admitting private finance would cost much, much more.

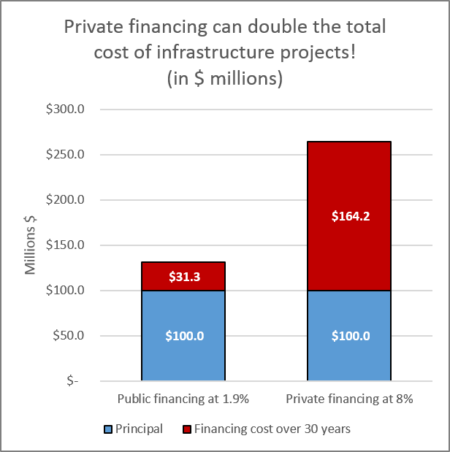

In fact financing a project at the 7-9% returns Sabia has previously said institutional investors expect from infrastructure investments would double the total cost of a project financed over 30 years compared to what it would cost if the federal government borrowed directly to finance it (at its current 1.9% 30-year bond rate), as is illustrated in the chart below.

It is perfectly understandable why Sabia, Wiseman and other large investors are aggressively pushing Ottawa to establish an infrastructure bank–so they can boost their returns at the public’s expense–but it would be extraordinarily foolish and irresponsible for any government to do so.

____________________________

Match made in heaven?

Finance Minister Bill Morneau’s Advisory Council on Economic Growth makes it look like match made in heaven. Canada’s public sector has billions in unmet public infrastructure needs while major capital investors have trillions in surplus funds they want to invest to earn stable higher returns.

But in any big-money wedding, someone has to foot the bill. In this case it will be the public through higher costs, lower revenues and new user fees.

The advisory council is calling on Ottawa to create a Canadian Infrastructure Development Bank and fund it with $40 billion. They suggest this would attract an additional $160 billion from private institutional investors to finance large public infrastructure projects, including toll highways and bridges, high-speed rail, ports, airports, power transmission, public transit, “smart-city”, broadband and natural resource infrastructure.

They say the arm’s-length bank should develop a “pipeline of scalable projects with reasonable certainty,” and revenue streams in the form of user fees, availability payments (public funding) and ancillary funding. It would review infrastructure projects over $100 million and select those with enough revenue potential—the cream of the crop—for private financing and investment.

They also recommend Canada “create a flywheel of investment in its infrastructure by catalyzing the participation of institutional capital in existing assets.” This simply means privatization, although they lack the courage to use that word, and say it doesn’t necessarily mean outright sale. Private finance could just suck money out with minority ownership. This “flywheel of investment” would become an endless cycle of privatization with private finance cannibalizing our public assets for private profit.

Why are these bad ideas?

There’s no shortage of low-cost public financing available to Canadian governments. Ottawa can now borrow at 0.6 per cent over a year and issue 30-year bonds at 1.8 per cent, with provinces a percentage point higher. Long-term borrowing rates have never been this low.

Meanwhile large private infrastructure investors expect “stable, predictable returns in the 7 to 9 per cent range”, according to Michael Sabia who is CEO of Quebec’s Caisse de dépôts pension fund and a member of Morneau’s economic advisory council. This is why he and other major investors are heavily pressuring Canadian governments to include private finance in the hundreds of billions they’re investing in public infrastructure.

It doesn’t take an economist to understand it makes no sense to finance projects at 7 to 9 per cent when you can do so at 2 per cent. Financing at 2 per cent for a $100 million project amortized over 30 years adds $34 million to its cost, while 8 per cent adds $165 million: almost five times as much in financing costs and doubling the total cost, including the principal.

No sensible person would do this with their own mortgage, nor do so in an obvious way with other peoples’ money (OPM) as a politician. That’s why they dress these projects up as public-private partnerships, or “innovative infrastructure financing”, as the Advisory Council proposes with this bank.

The public will always ultimately pay for these higher private financing costs through ongoing public subsidies, lower public revenues, higher user fees and in other ways.

Privatization doesn’t just increase costs, it also results in greater inequality, as user fees are hiked, workers’ wages and benefits are cut, and executive compensation rises. This would severely undermine the Trudeau government’s commitment to support the middle class and reduce inequalities.

It’s unlikely governments would benefit from higher corporate tax revenues, as many projects would be owned by foreign investors and based in tax havens. Foreign ownership also leaves our governments vulnerable to being sued through controversial Investor State Dispute Settlement provisions in trade deals such as NAFTA, CETA and the TPP.

University of Toronto expert Matti Siemiatycki has made much more constructive proposals for a national infrastructure bank that would reduce rather than increase the cost of financing for public infrastructure and increase accountability and transparency over these decisions.

How the Trudeau government responds to these recommendations will be a moment of truth. Will they bend to the interests of private finance or genuinely adopt policies for “inclusive growth” in the interests of all Canadians.

Toby Sanger is the senior economist for the Canadian Union of Public Employees.

This column was first published in the Oct. 31 edition of the Hill Times.

See letter in Vancouver Sun (with footnotes) posted at:

http://unpublishedottawa.com/letter/103821/use-bank-canada-fund-infrastructure

“However, having won the election by outmaneuvering the NDP on the left, the Liberals will now reward their big-money supporters by offering high interest returns on investments and the ability to extract monopoly rents through on-going operations. Even the government’s private sector consultant admits that, “infrastructure … will be of huge interest to foreign investors in search of steady returns ……Infrastructure is the new fixed income.”

I brought P3s up regularly in every online discussion I was in – that talked about the Liberals’ intention to do infrastructure spending – during the last election and was ignored. The media, Left and Right wouldn’t talk about it even though journos would have known this was in the works. The Council of Canadians, as I recall (Emma Lui) was one of about two sources that looked at Trudeau’s intention to go the P3 route (endorsing thereby Harper’s law requiring infrastructure spending above a certain amount to be done via P3s, because Trudeau’s such a change from Harper). Some journos who I expected to say something were quiet. A few of them may now be vocal, but where were they during the election? Was the priority to get rid of Harper? If that’s what they would claim, I’d have to say that their silence wasn’t about that priority. Do you know where we are when everyone jettisons principles? It’s called the end.

I don’t mind terribly if my pension fund is benefitting from it. Notice that the most vocal supporters have been the Caisse, OMERS and CPPIB. I’m not one of those who believe that a pension fund is any other obligation than to its beneficiaries, and in the case of public pension plans, beneficiaries are the entire Canadian population.

What Mr. Sanger, in this and other articles, seems to shy away from, is the ability to use the Bank of Canada to create whatever infrastructure funds the public needs. The solution is not borrowing at low rates, the solution is not borrowing at all. Creating debt-free money to build infrastructure is proven not to be inflationary either, because whether you borrow the money or create it, the same amount gets spent on the infrastructure, the same number of jobs are created. It’s just in the latter you don’t have to raise taxes to pay the interest.